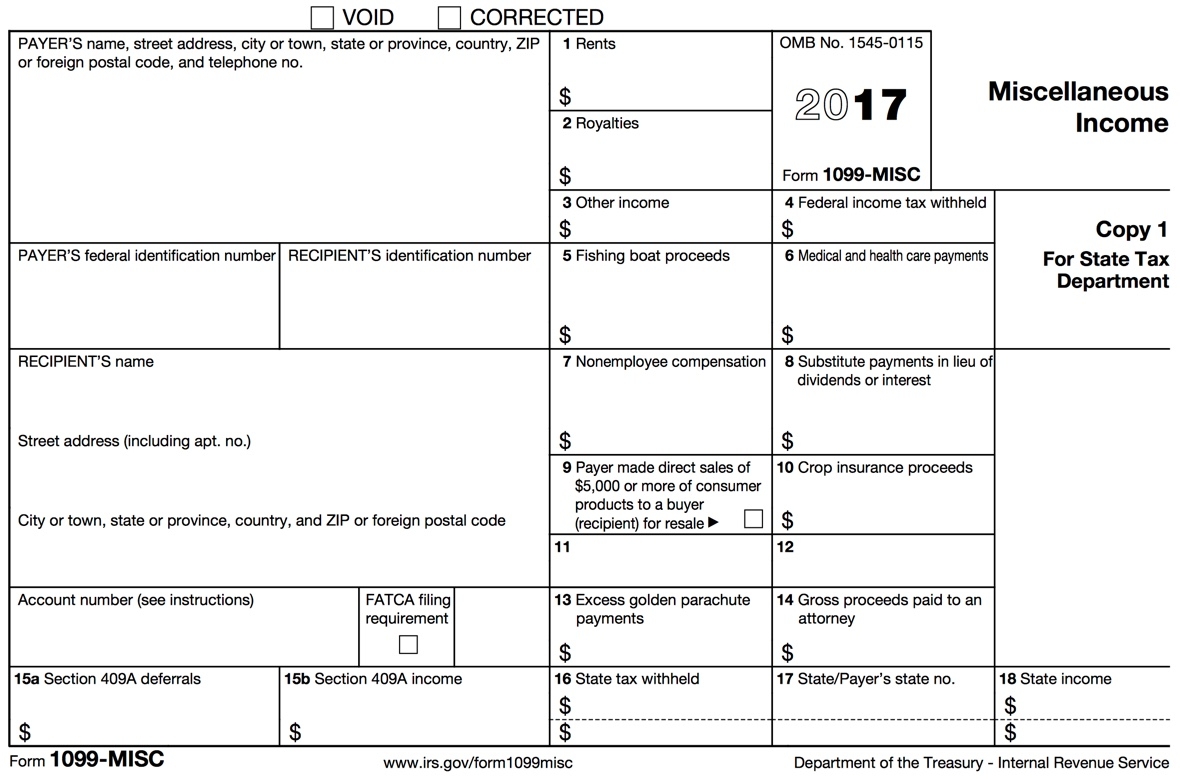

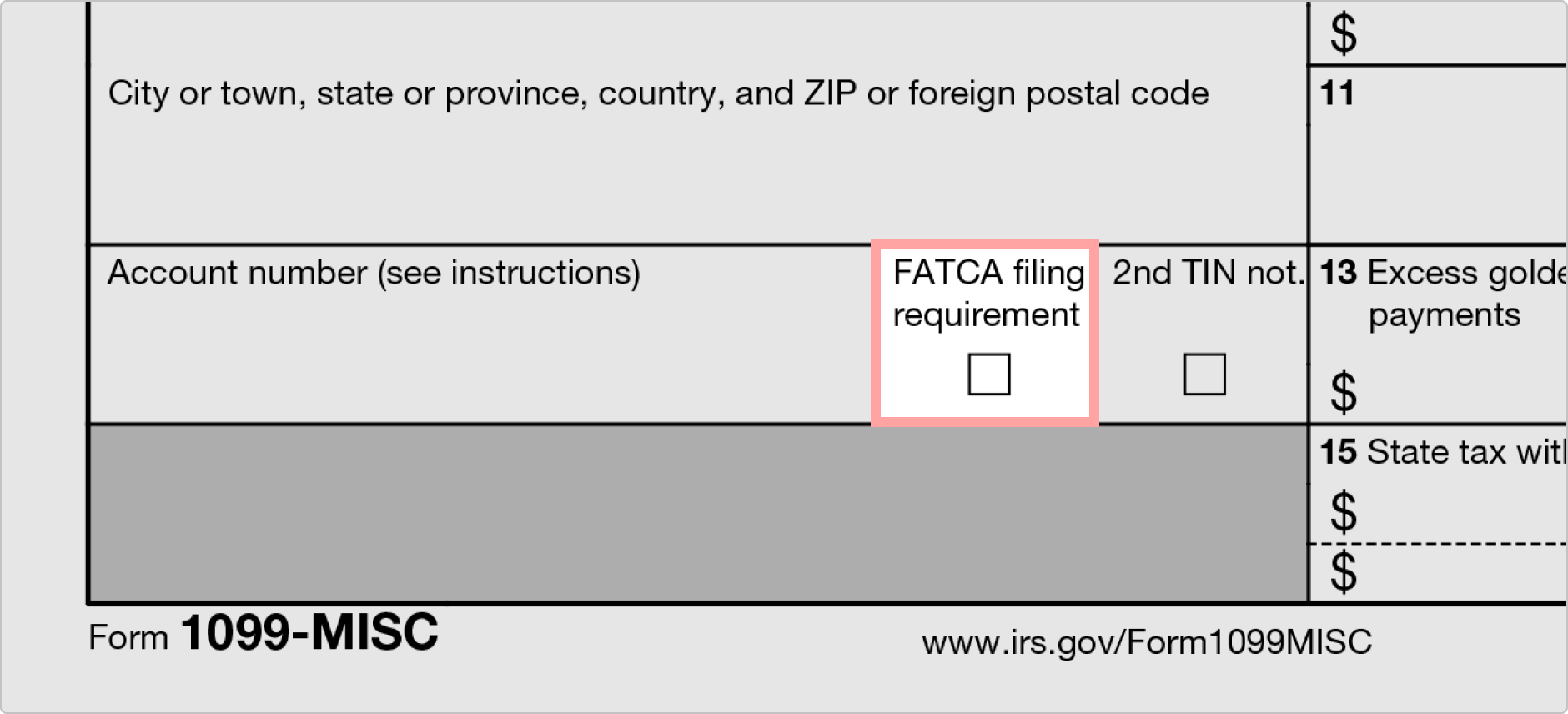

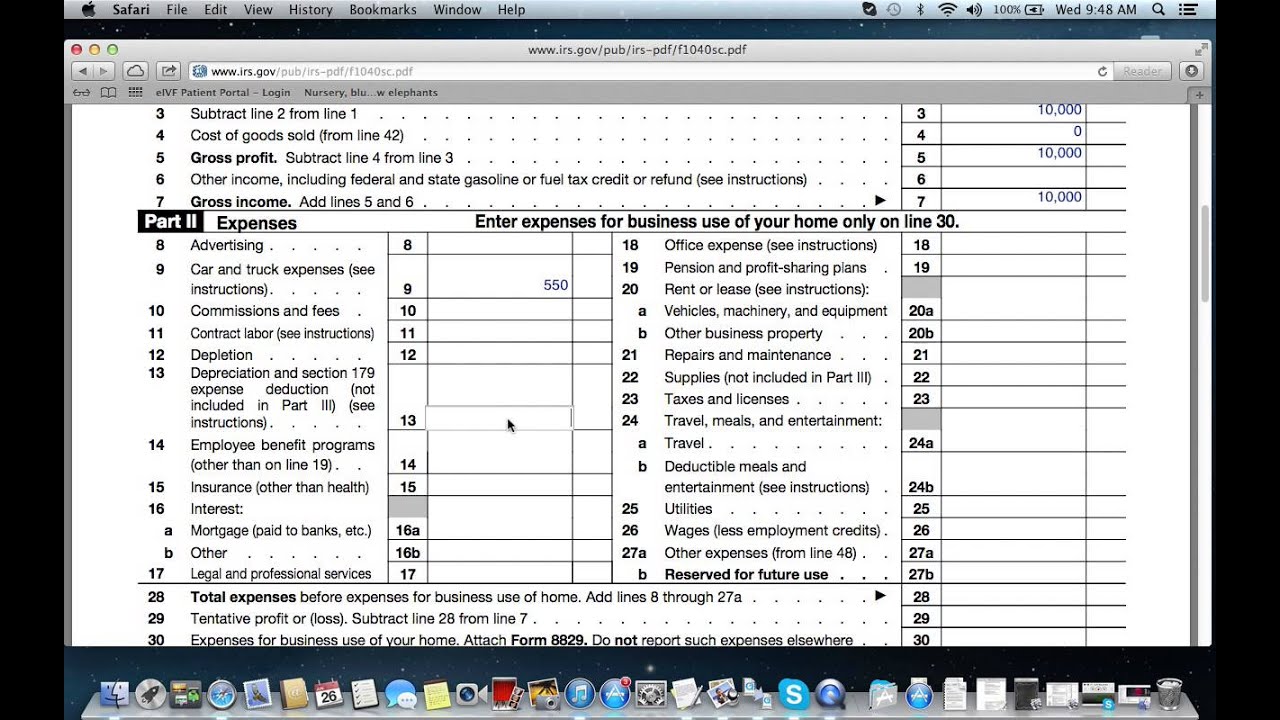

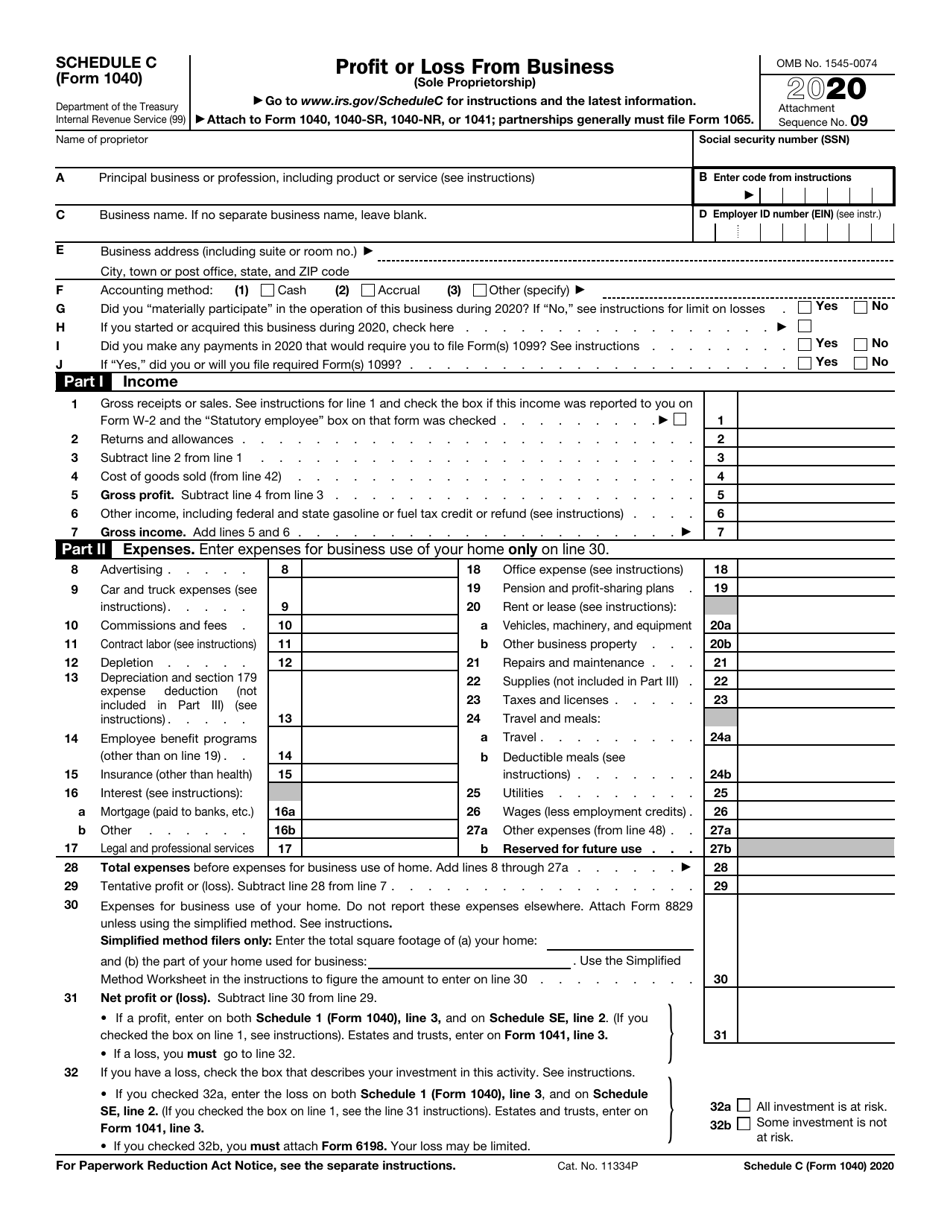

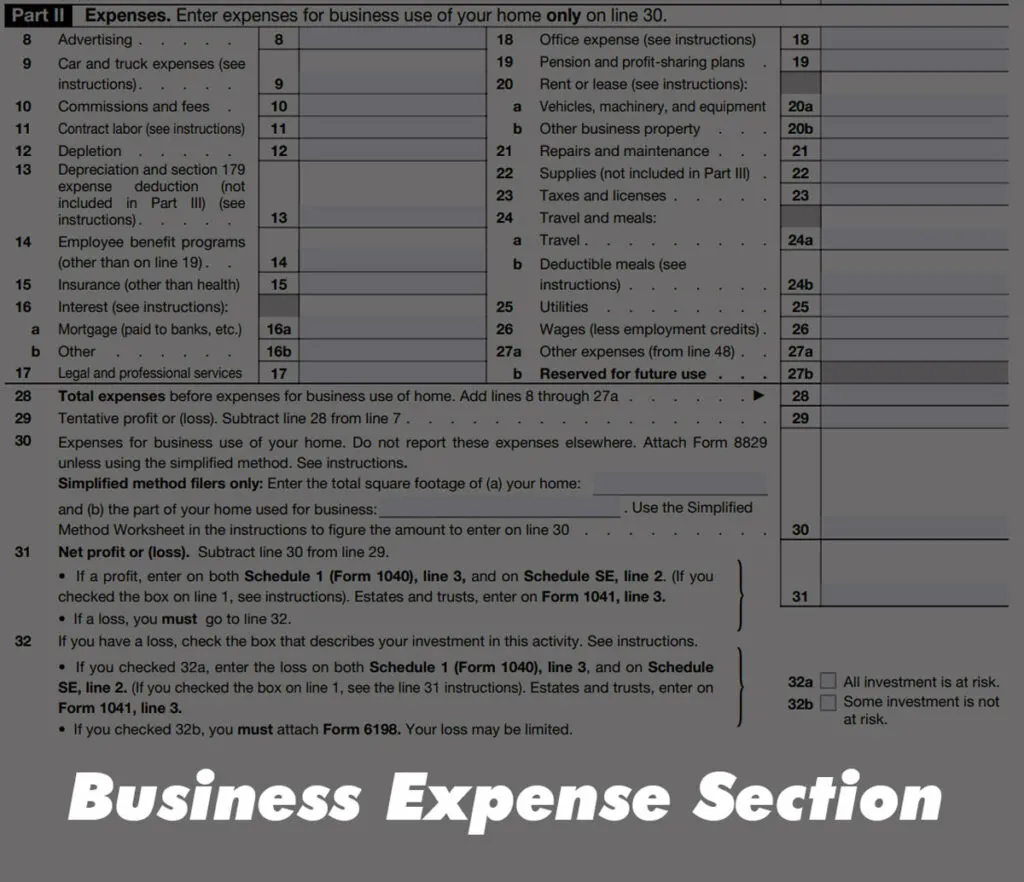

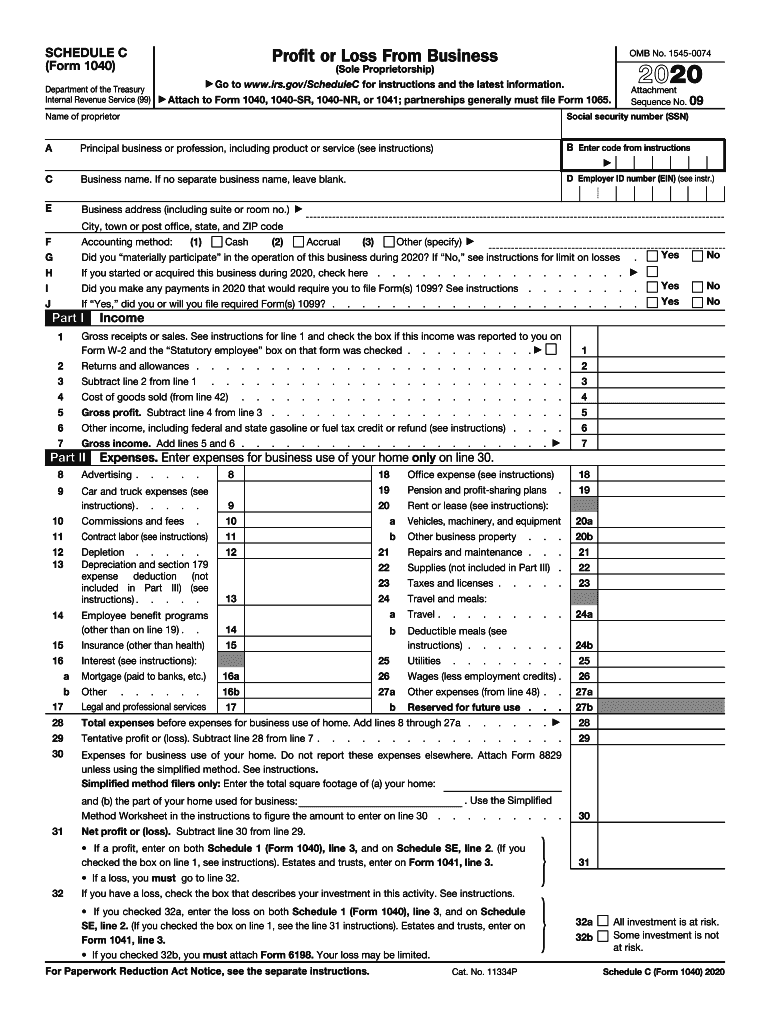

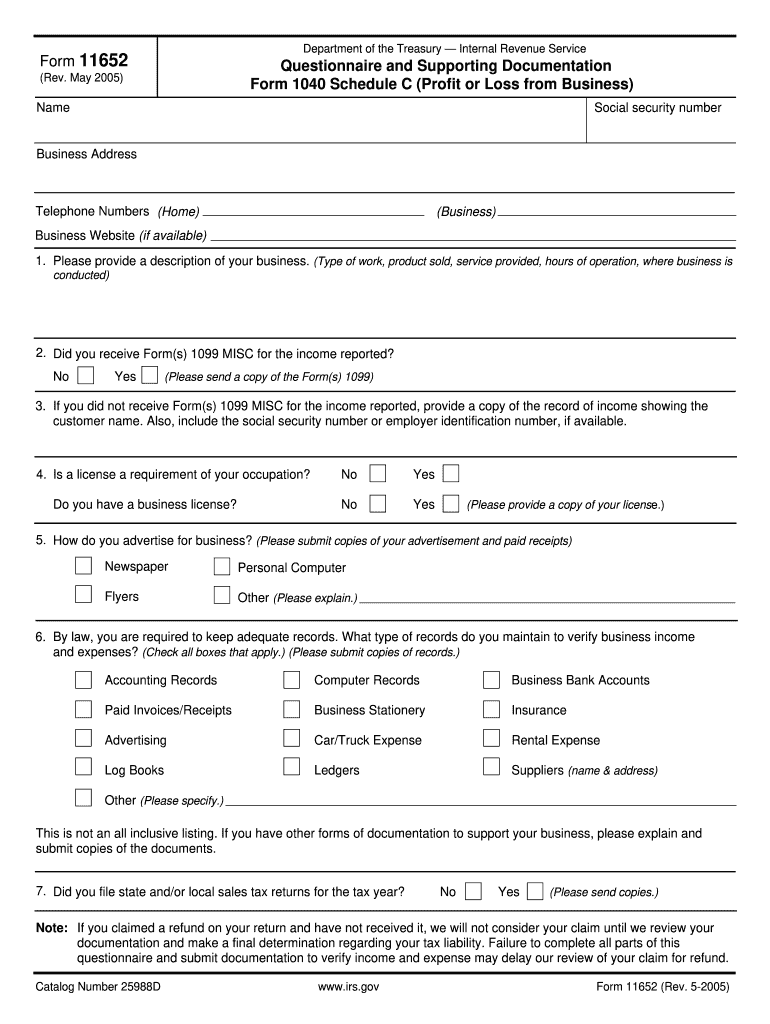

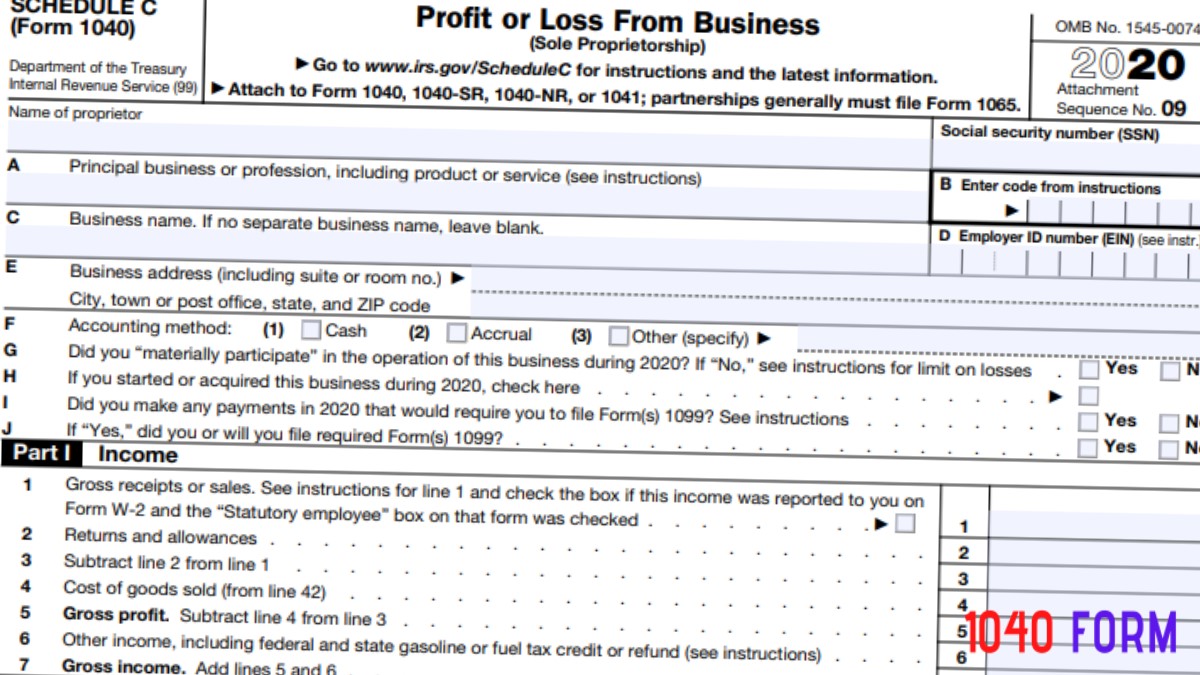

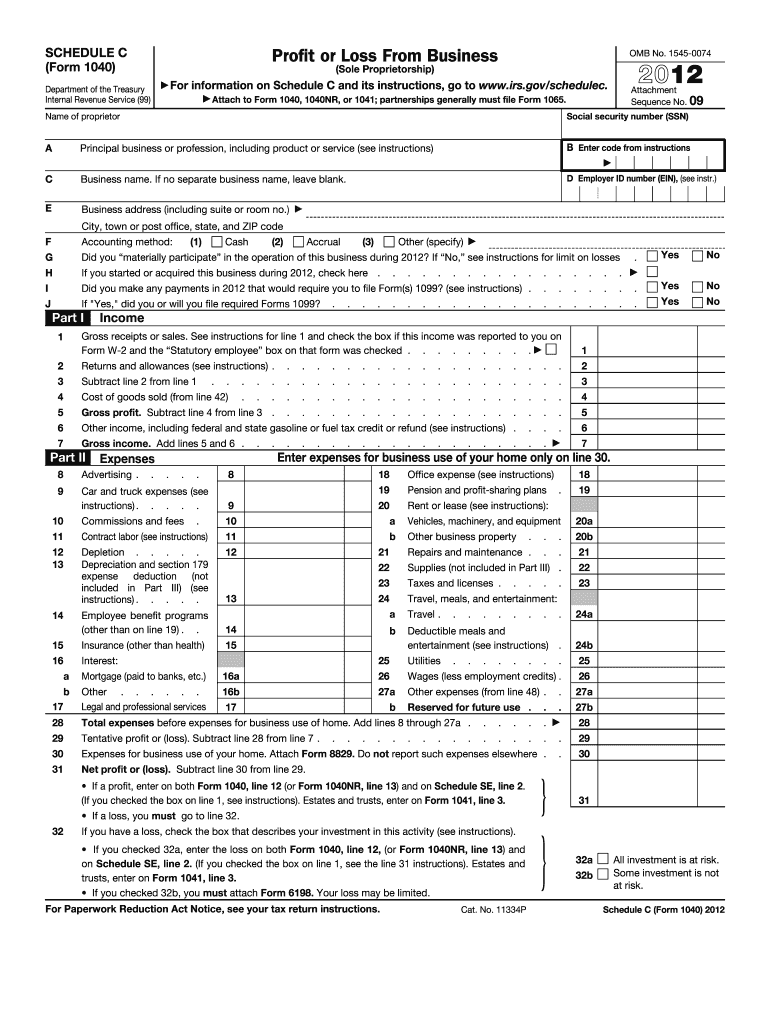

Form 1099 Schedule C Business Expenses In this day and age, every penny counts, and the tax returns of independent contractors are a testament to this Contractors can lose out on thousands of dollars each year simply for not tracking business expenses These expenses (that you're incurring anyway) can be written off each year so you canSchedule C A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business Use it to tell the government how much you made (earnings), how much you spent (expenses), and if that resulted in a profit or lossForm 941 SS Employer's Quarterly Federal Tax Return (American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the US Virgin Islands) Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return Form 940 Schedule R Allocation Schedule for Aggregate Form 940 Filers Form 940 PR

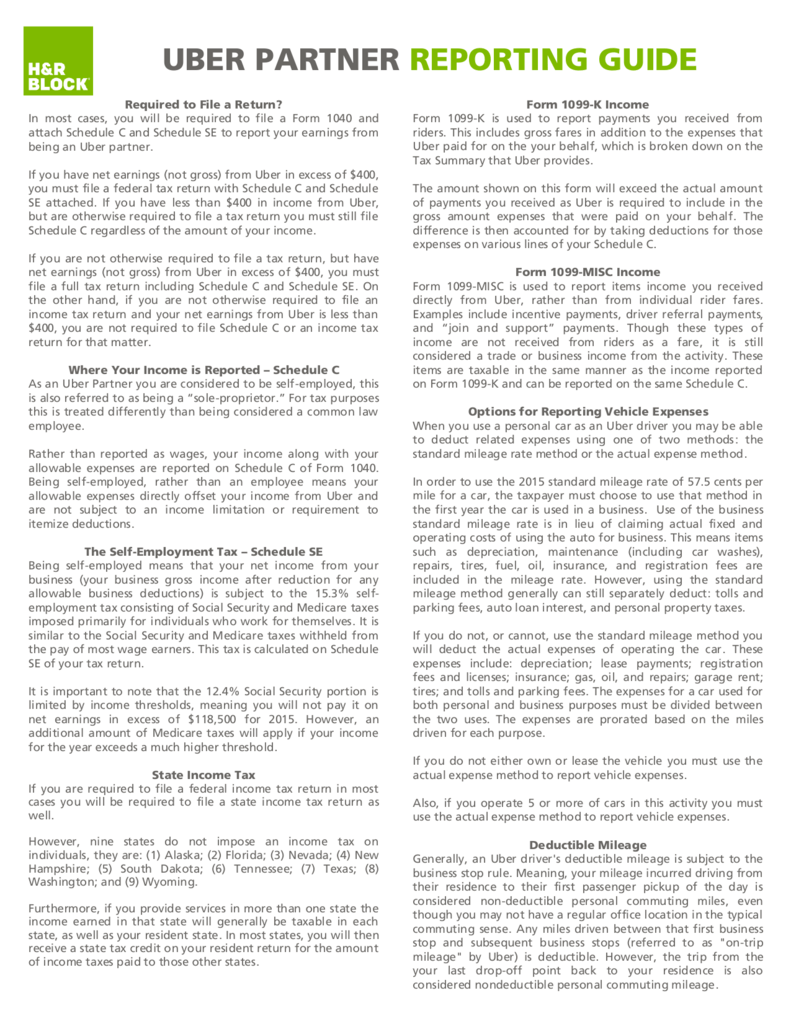

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

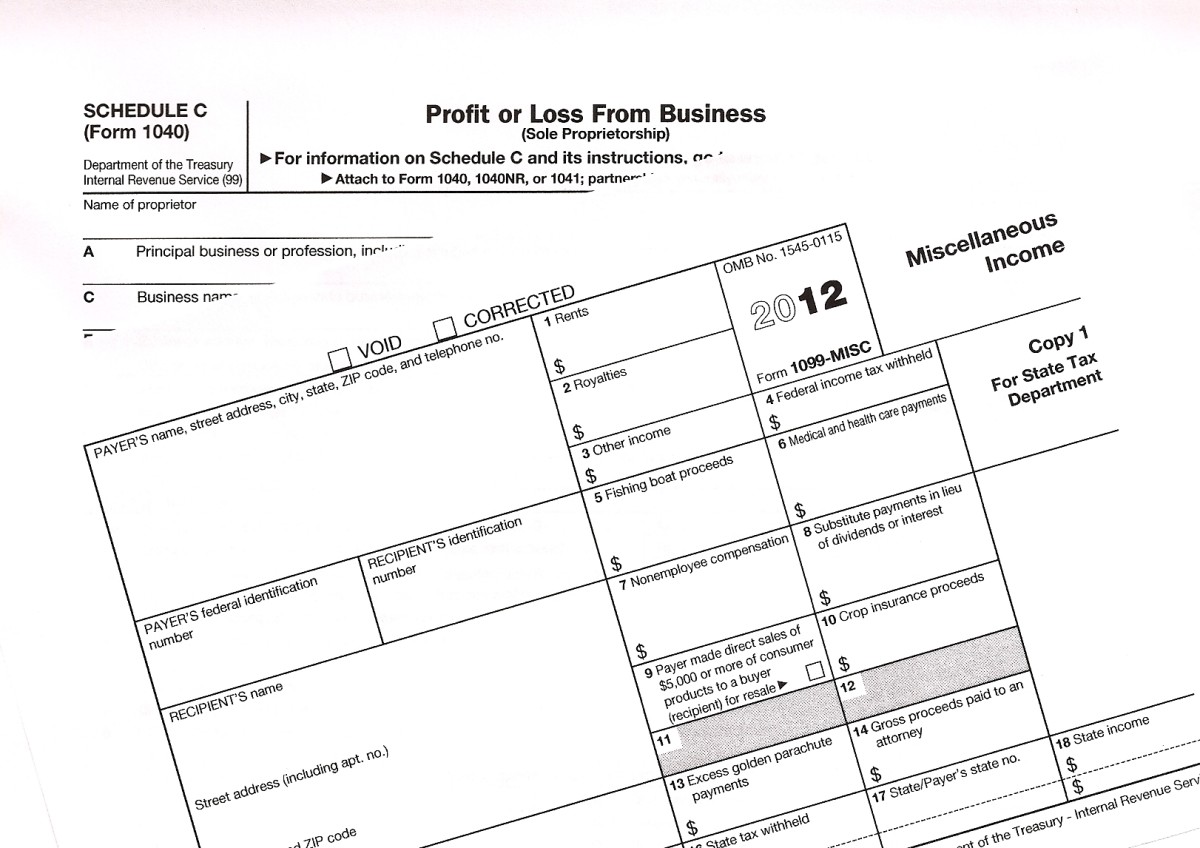

Schedule c tax form 1099 nec

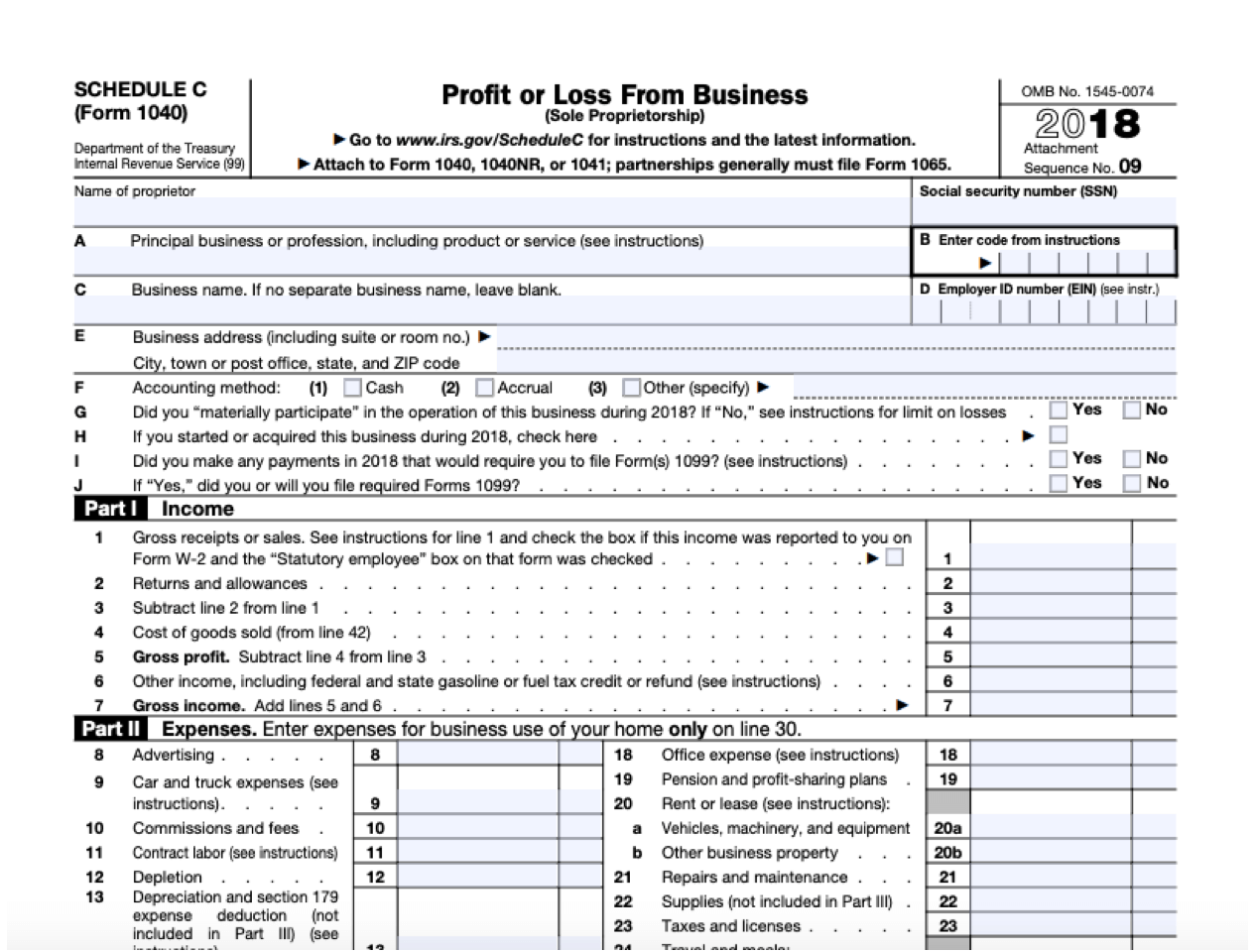

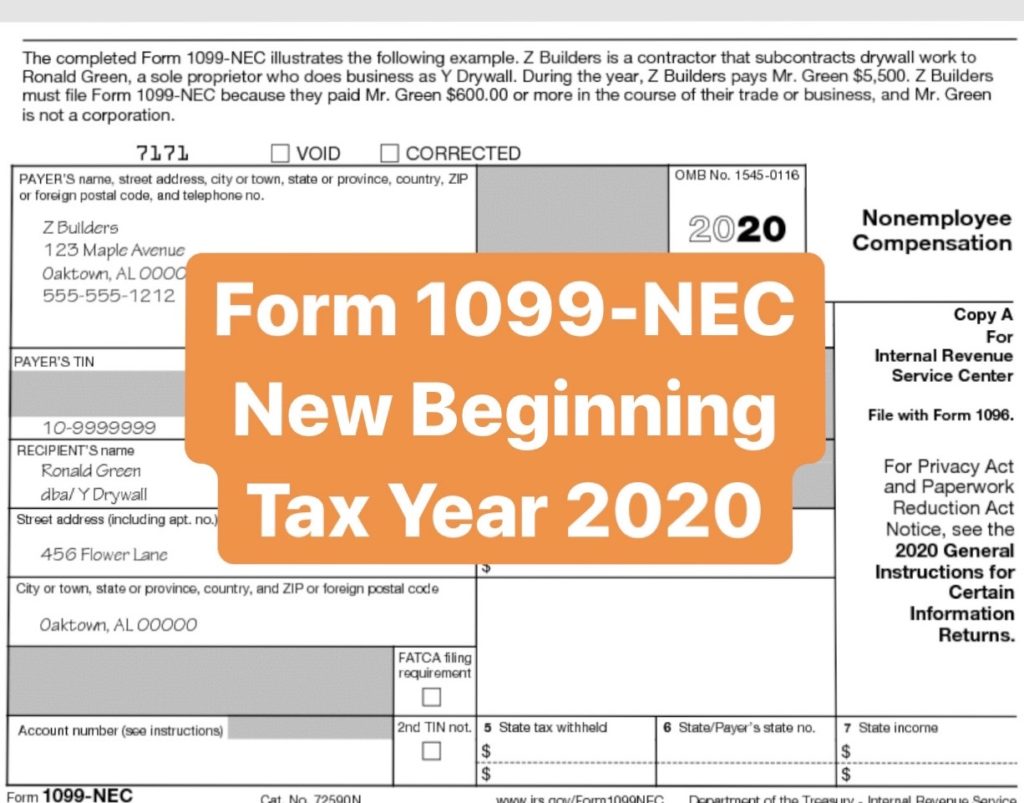

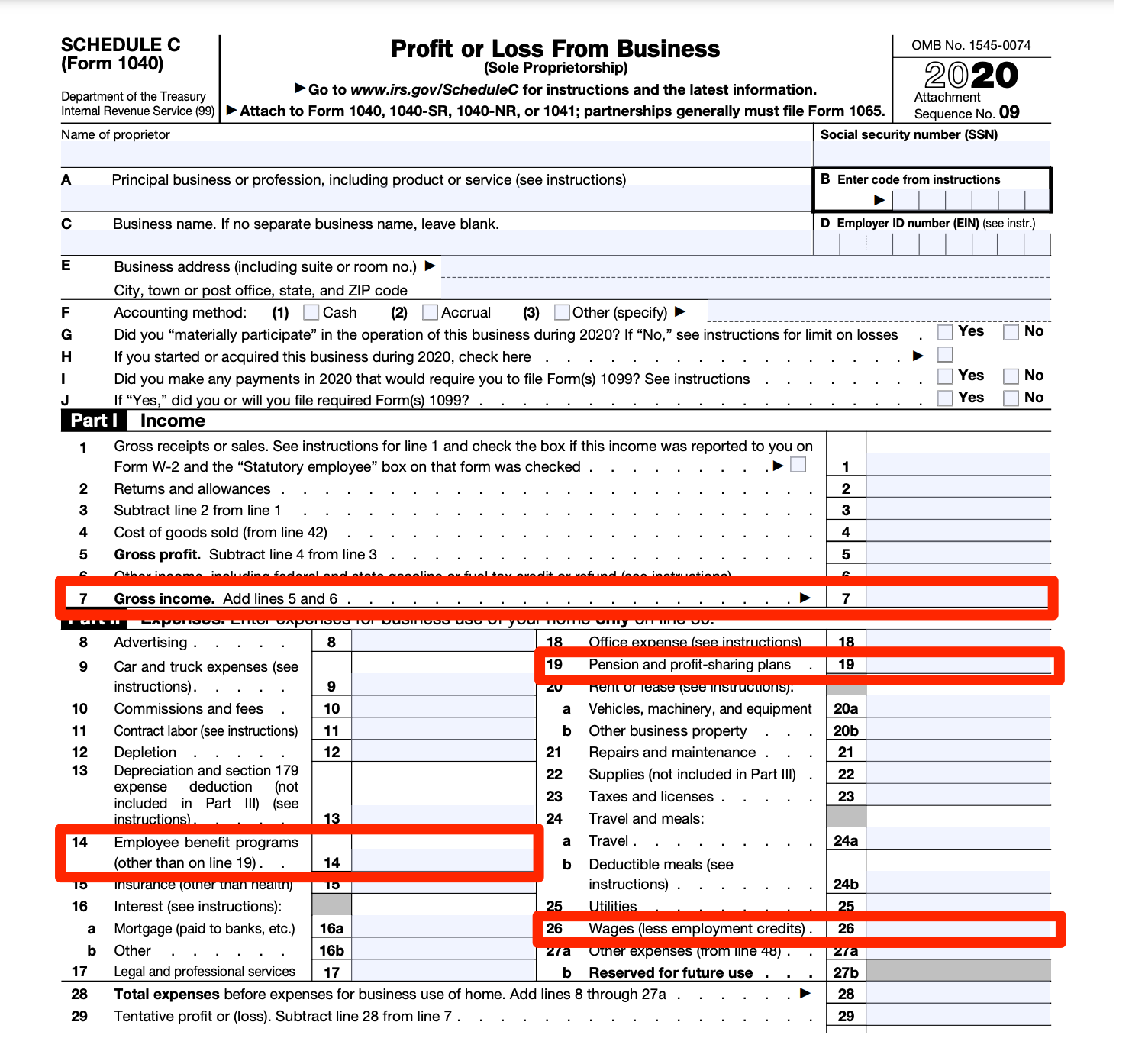

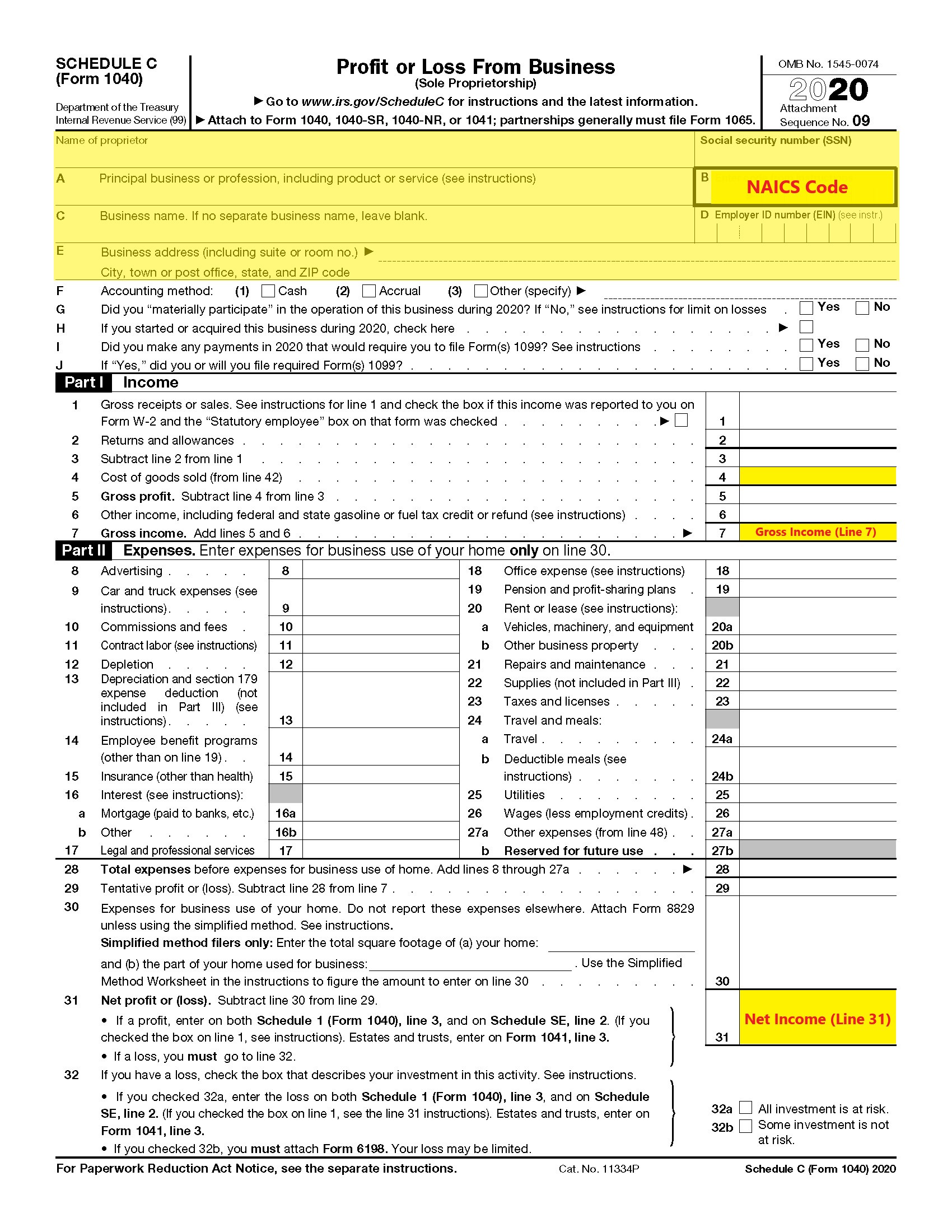

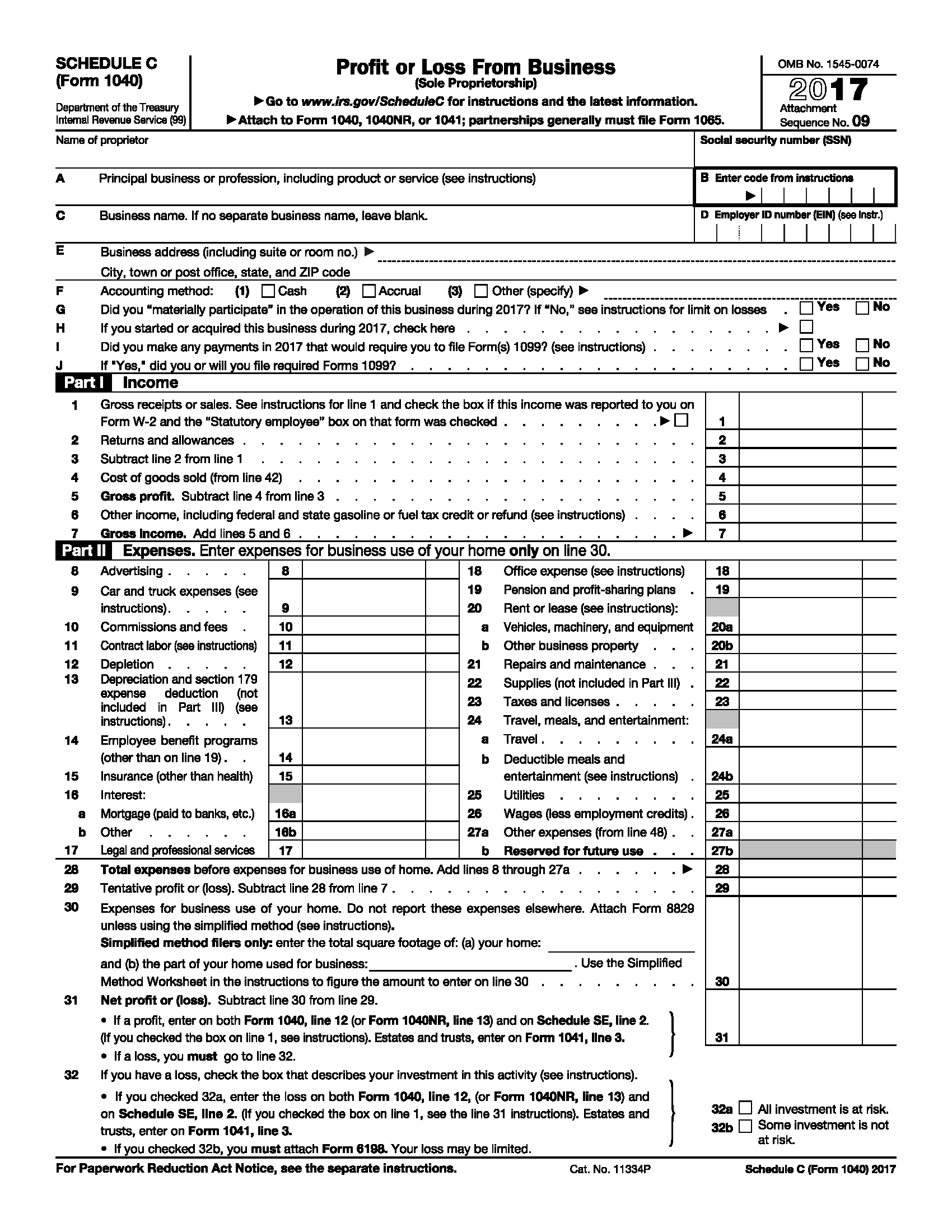

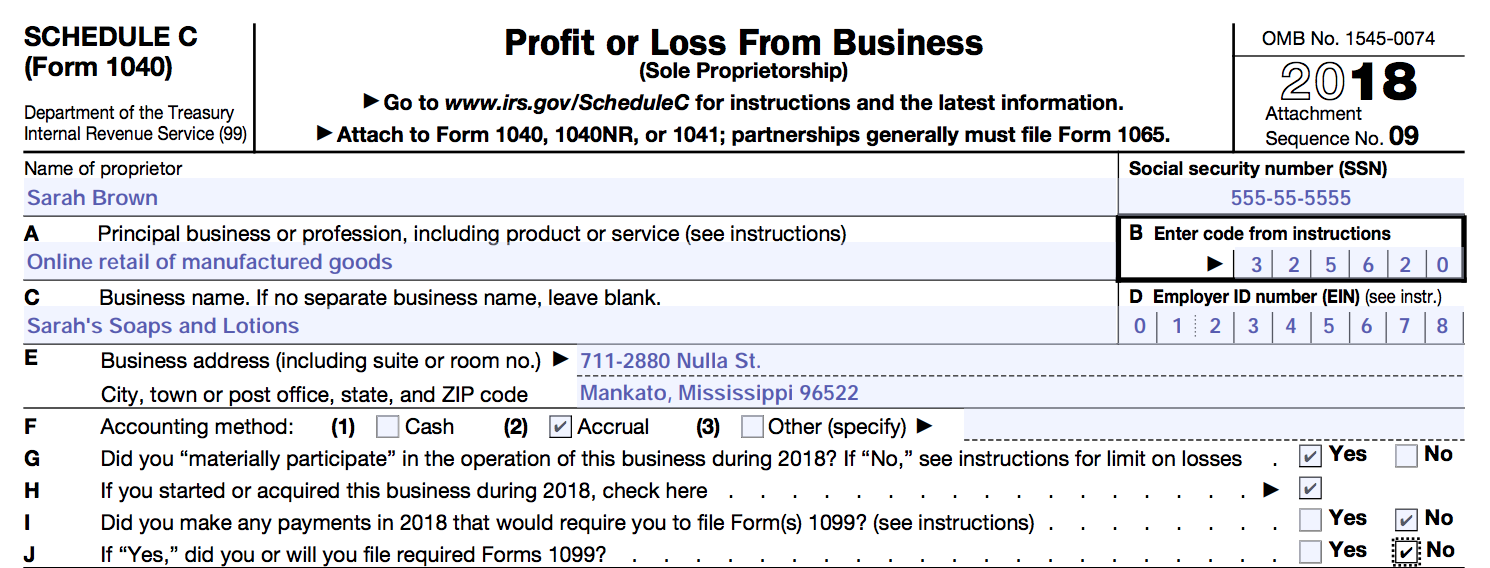

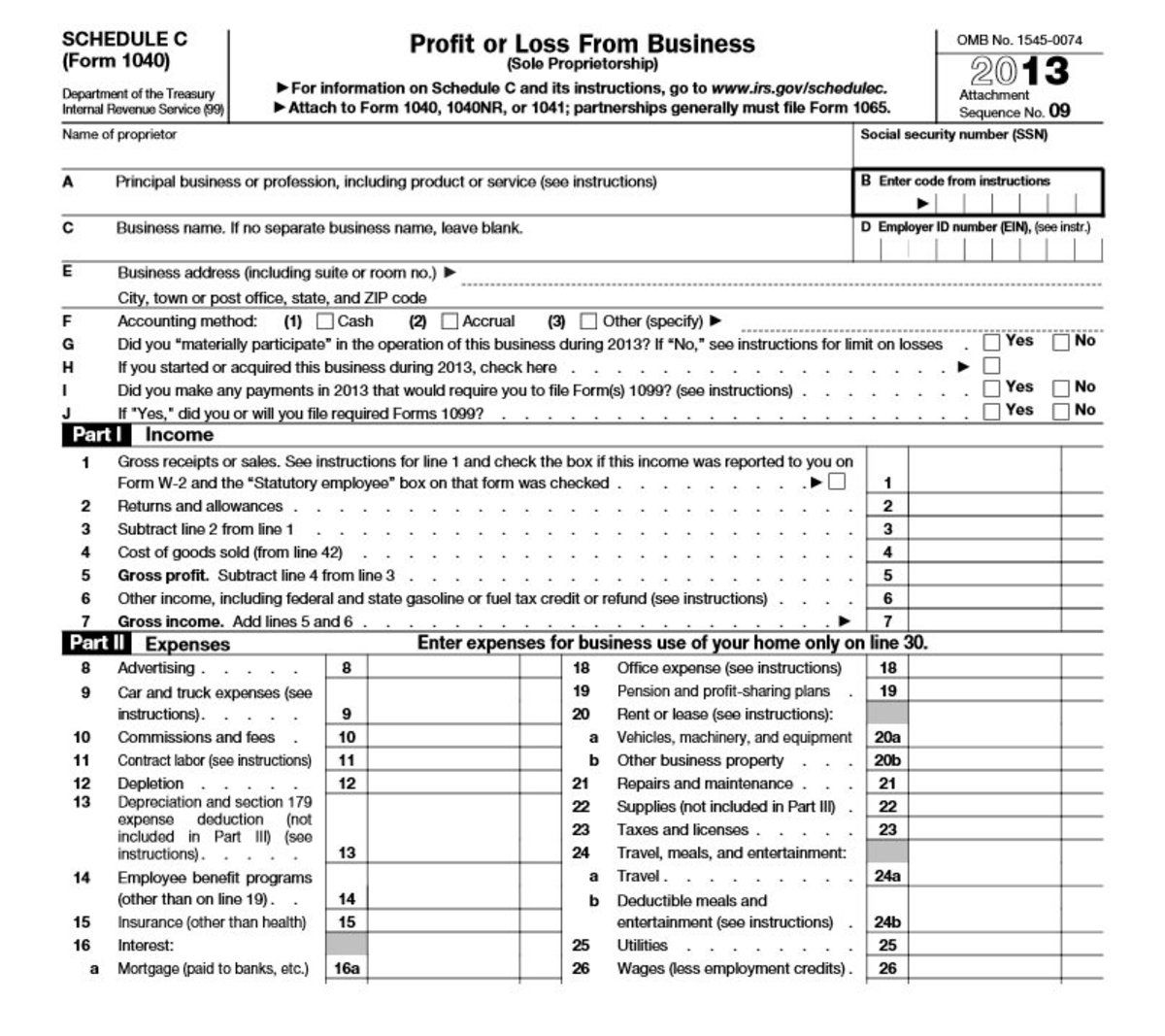

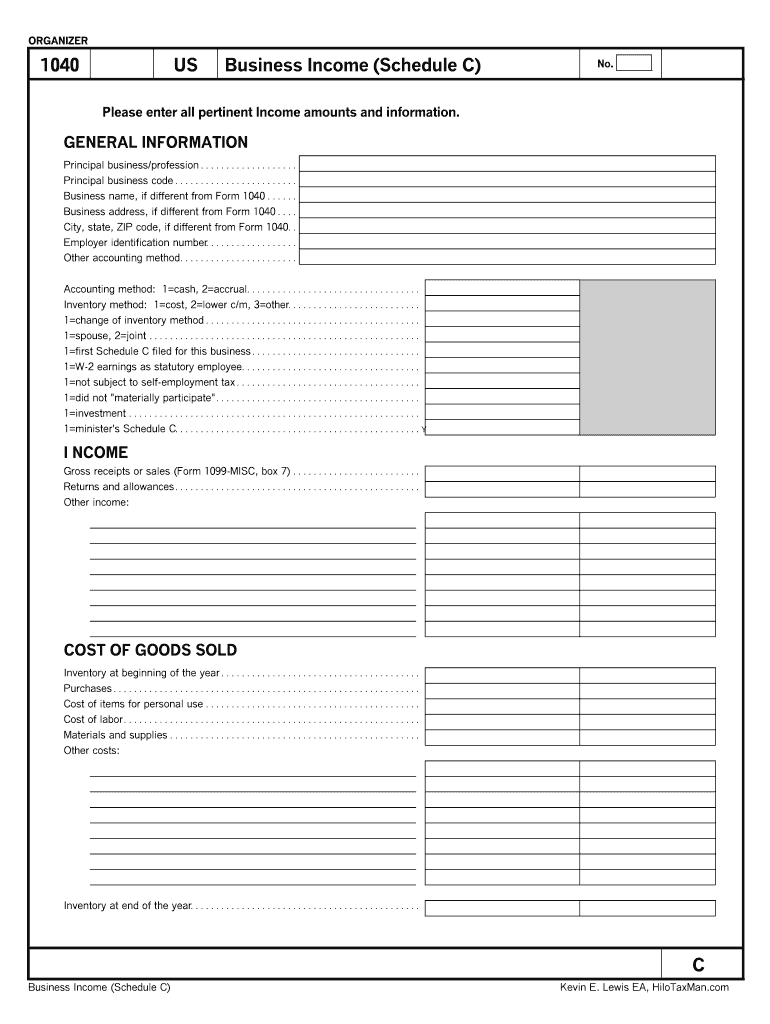

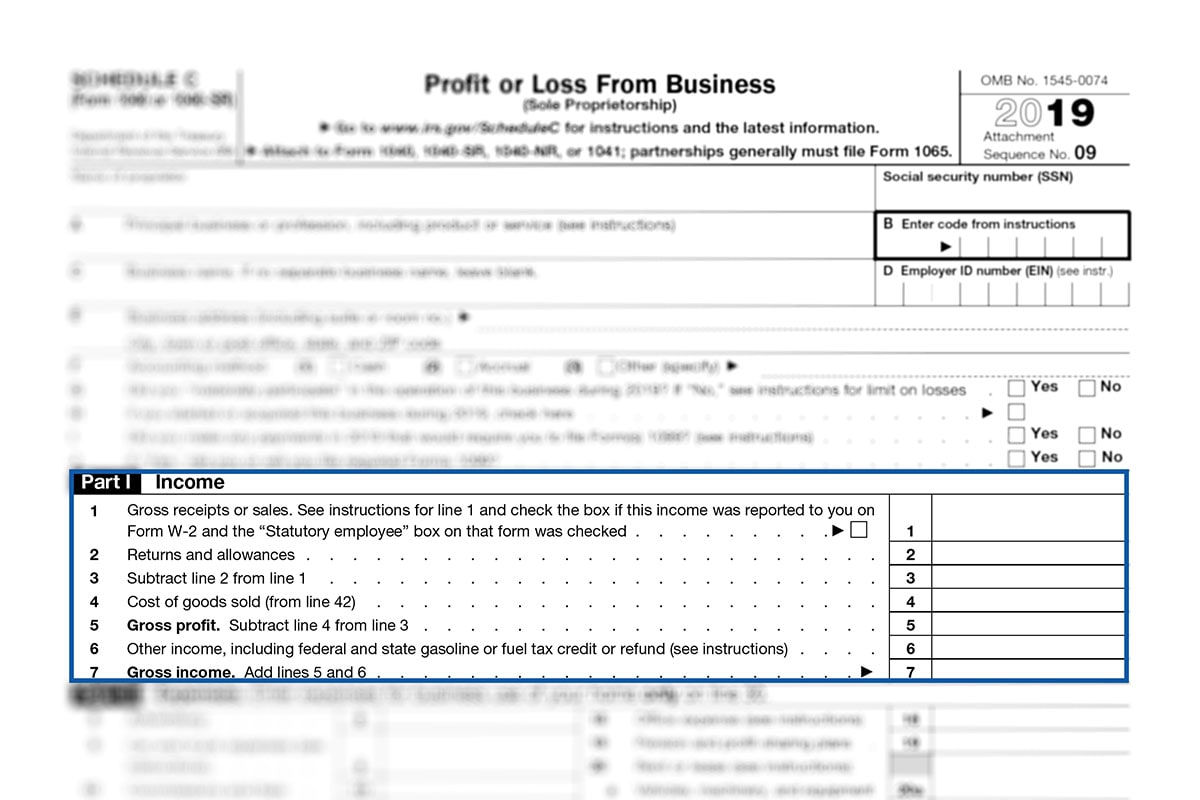

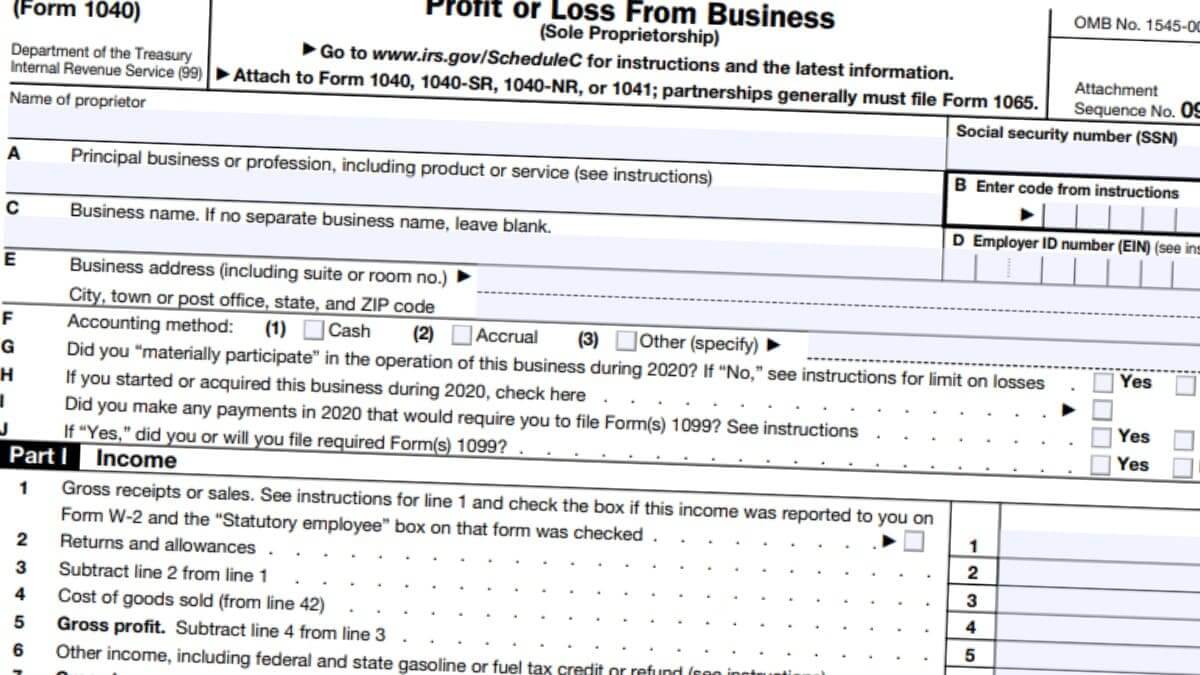

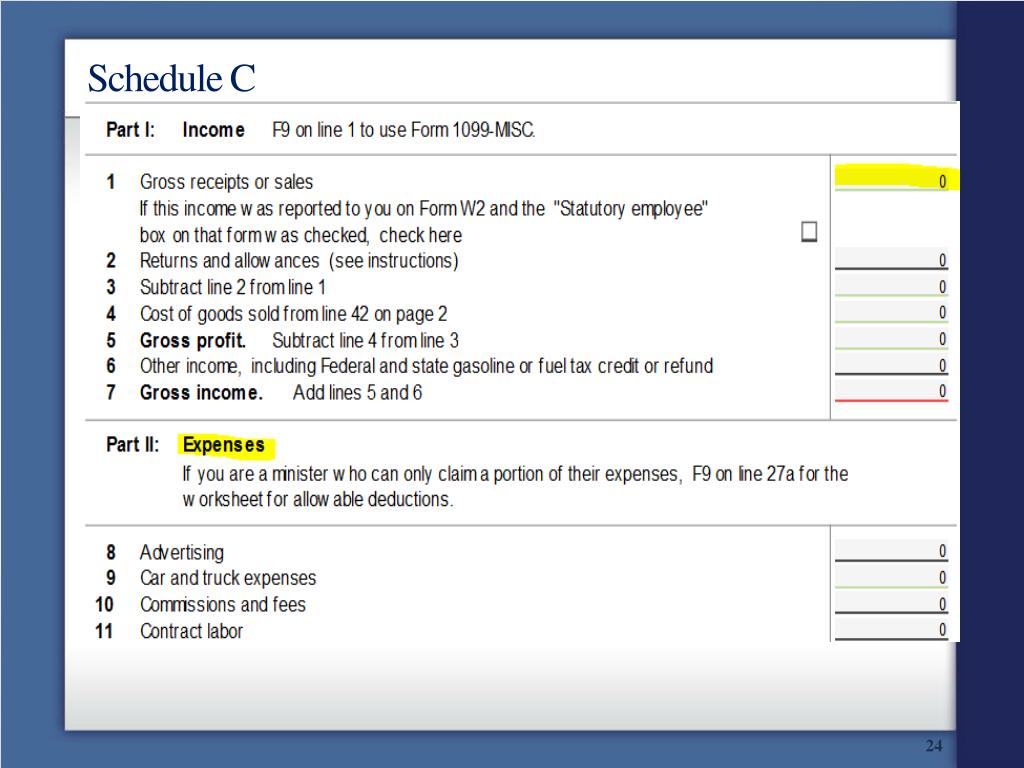

Schedule c tax form 1099 nec- Schedule C is used to state the profit income or loss from your business with the Internal Revenue Service (IRS) This is filed with the use of your 1099 Forms To get the better view about the types of expenses, just have a look at the below table The table will list each type of business expense that comes in the Schedule C29/1/ Updated Small business owners who are filing business taxes as a sole proprietorship or singlemember LLC must file using a Schedule C (Form 1040) to report profit or losses An activity qualifies as a business if the primary purpose is to generate income or profit, or if you're involved in the activity on an ongoing basis 1

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

It includes your income, your deductions, and details about yourself and your business Each section of the Schedule C affects your tax liability, just like on the 1040 The goal of the Schedule C25/1/21 Including 1099 Income on Your Tax Return How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From BusinessWhen you complete Schedule C, you report all business income and expenses2/3/21 Schedule C is the form used to report income and expenses from selfemployment This can encompass owning a digital or brickandmortar small business, freelancing, contracting, and gig work such as rideshare driving If you receive a Form 1099MISC, 1099NEC, and/or 1099K, you are likely to have to report it on Schedule C along with other income

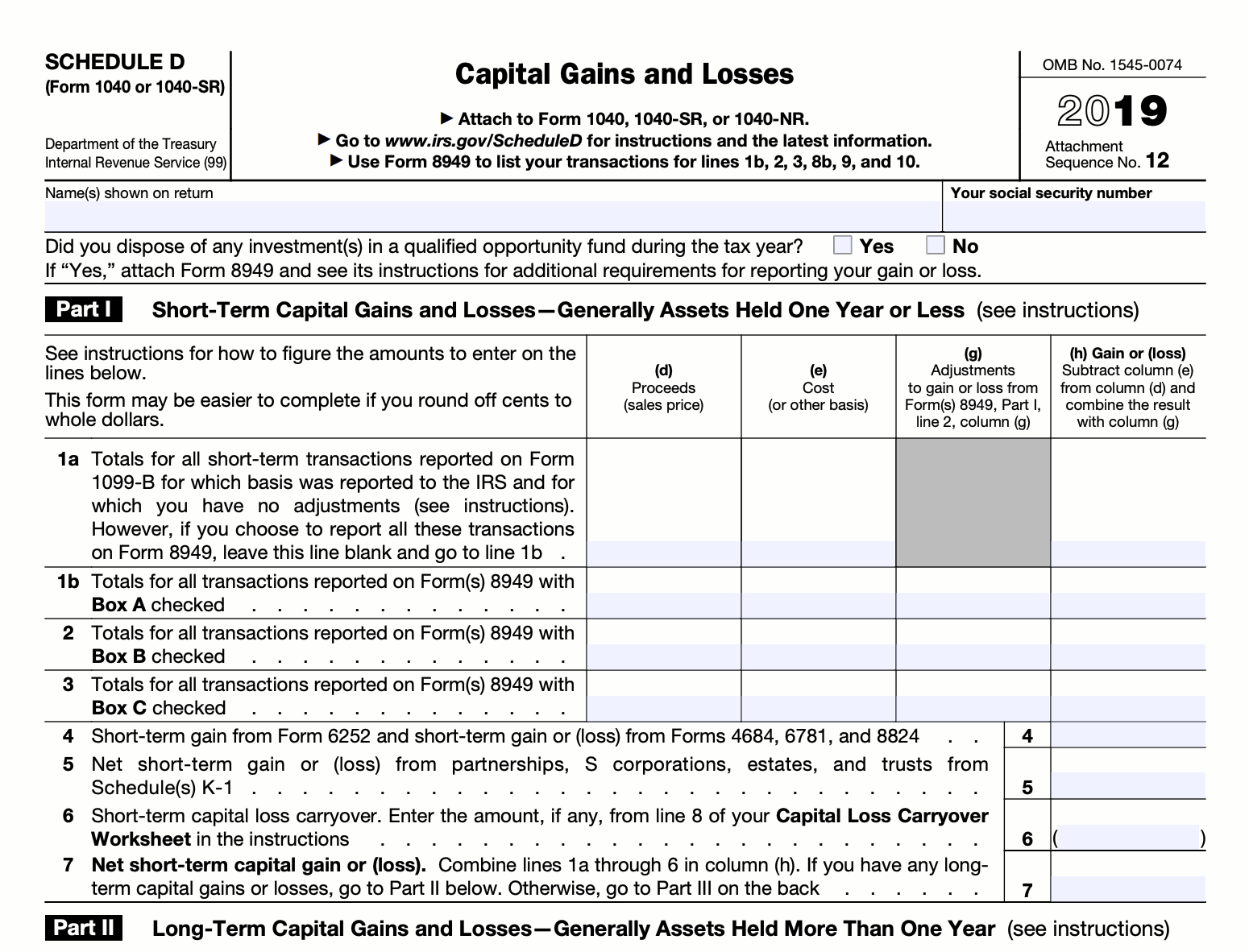

SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;1/2/21 Any income reported on Form 1099NEC is not reportable directly on your tax return Since this type of income is considered selfemployment (nonemployee compensation) it must be linked to a Schedule C, even if there are no expenses being claimed To add a Schedule C so your 1099NEC can be linked Open or continue your return in TurboTaxIf you have multiple Schedule C forms and multiple 1099M/1099NEC forms, make sure you enter the correct MFC (Multiform Code) In the example below, the florist would be MFC 1, landscaping MFC 2, and woodworking MFC 3 Delete the additional Schedules C that were generated incorrectly by the 99M/99N screen (s)

4/6/21 1099 schedule c 19C Business name If no separate business name, leave blank D Employer ID number Business address (including suite or room no) Author SEWCARMP Created Date Title 19 Schedule C (Form 1040 or 1040SR) Subject Profit or Loss From Business Keywords Fillable Last modified by(see instructions) Yes NoJ Schedule C (Form 1040 or 1040SR) 19 Schedule C (FormYou can Create a new Schedule C or add the income to an existing Schedule C (same type of work) The income from the 1099Misc Box 7 or 1099NEC will be automatically pulled to the Schedule C If you have already added the 1099MISC/1099NEC in the program you will need to take different steps to associate the Schedule C to the 1099MISC/1099NECIRS Form 1099G is used to report certain government payments If you received a 1099G Form this year from a government agency, you may need to report some of the information it contains on your tax return The most common use of the 1099G is to report unemployment compensation as well as any state or local income tax refunds you received

Ab 63 Sb 1146 Tax Discovery Los Angeles Office Of Finance

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Home » Others » Average Cost For Form 1040 And Schedule C With State » IRS Schedule C Instructions For 1099 Contractors Shared IRS Schedule C Instructions For 1099 you are able to get an IRS 1040 Form for tax planning or taxfiling purposes You might have received an IRS 1040 form in the IRS, or you may have received one via the31/1/ 1099MISC Schedule C If you receive income for nonemployee compensation, you must include it in income If you work in any capacity and did not receive a Form W2 for wages, you must complete Schedule C To enter the income from a Box 7, 1099Misc You can enter a 1099MISC on the 1099MISC Summary screen Schedule C New Form 1099 NEC 0548 AM Why they have not included the field to enter the income from 1099 C in Part I of the schedule C since most of the self employed will receive the new 1099 NEC I am assuming they

1099 Misc Form Fillable Printable Download Free Instructions

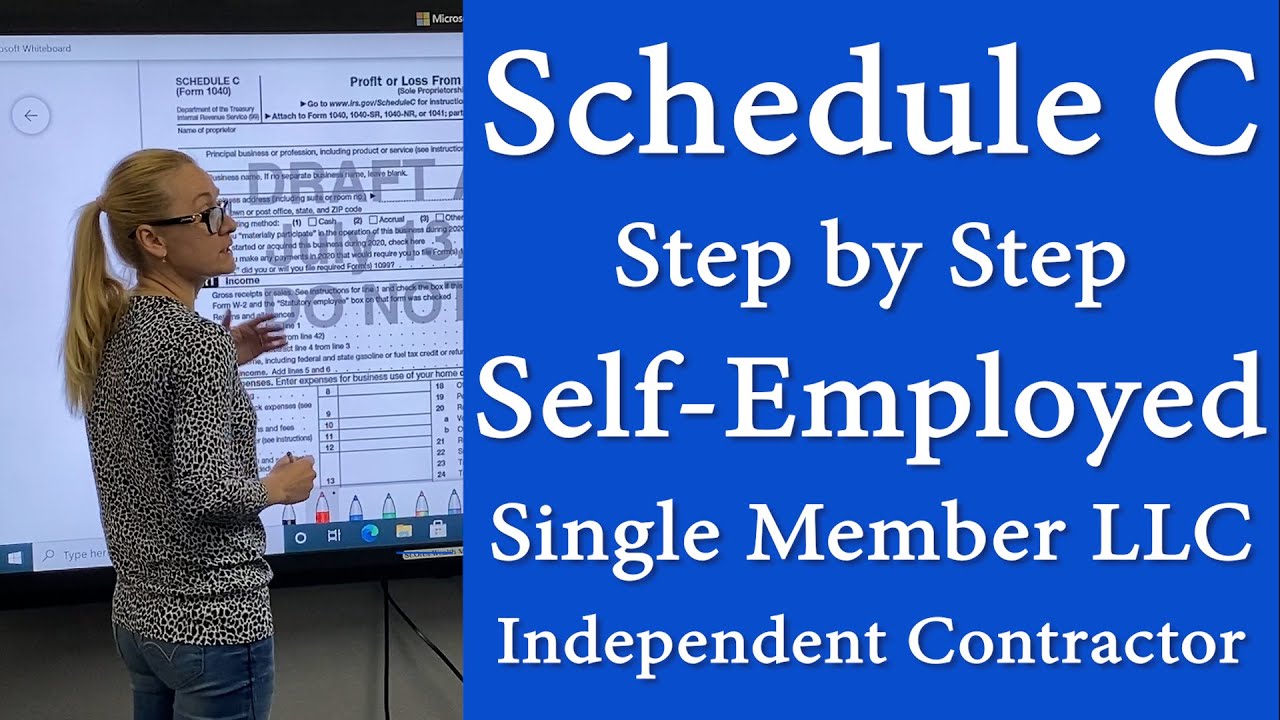

How To Fill Out Schedule C For Business Taxes Youtube

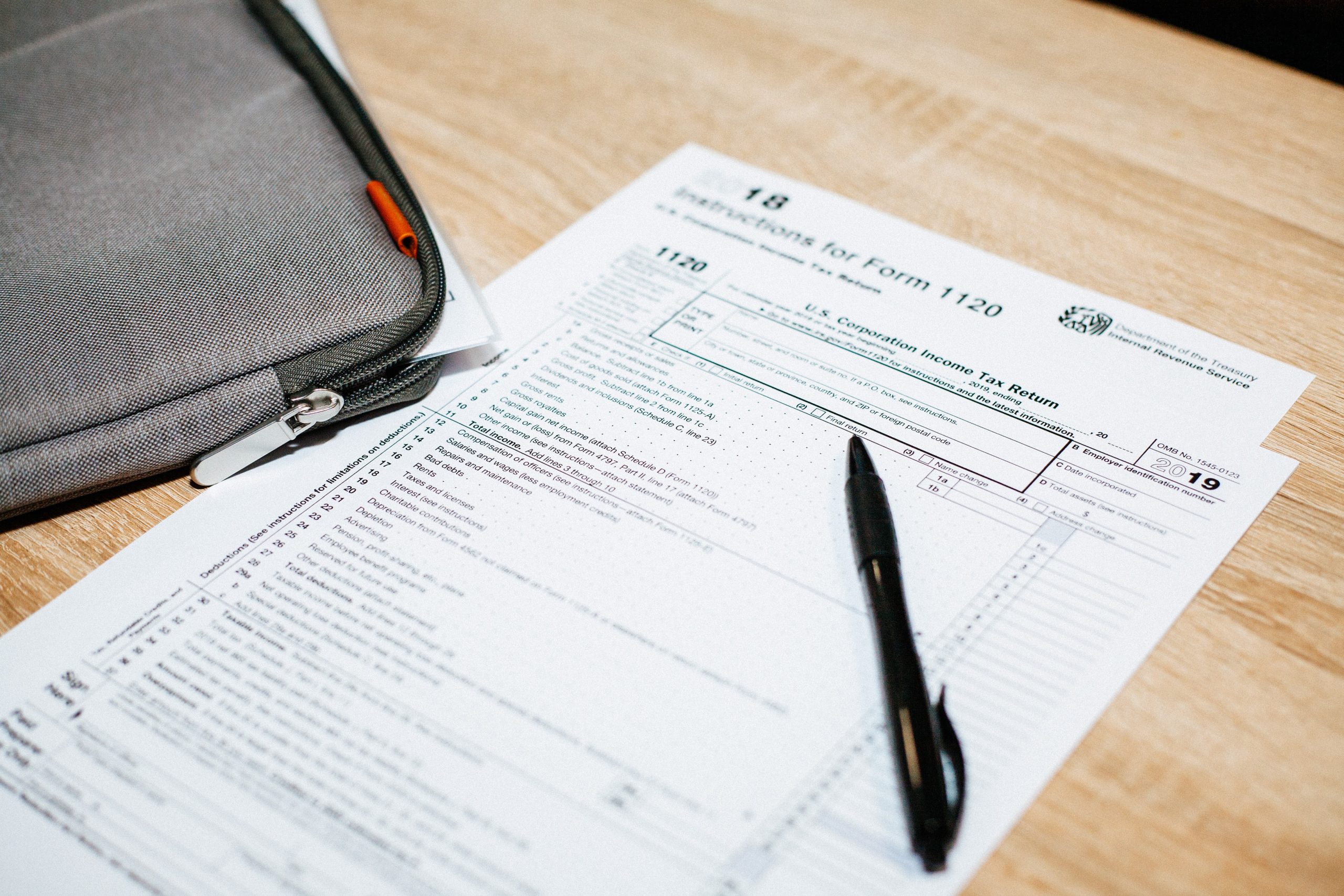

IRS Warns Tax Return Preparers About Schedule C Errors According to a new report in the Kiplinger Tax Letter, the IRS has mailed out more than 2,500 letters this month to taxHow to enter Form 1099NEC on a tax return (Schedule C) Generally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who isForm 11 (officially the "US Corporate Income Tax Return") is one of the IRS tax forms used by corporations (specifically, C corporations) in the United States to report their income, gains, losses, deductions, credits and to figure out their tax liability

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

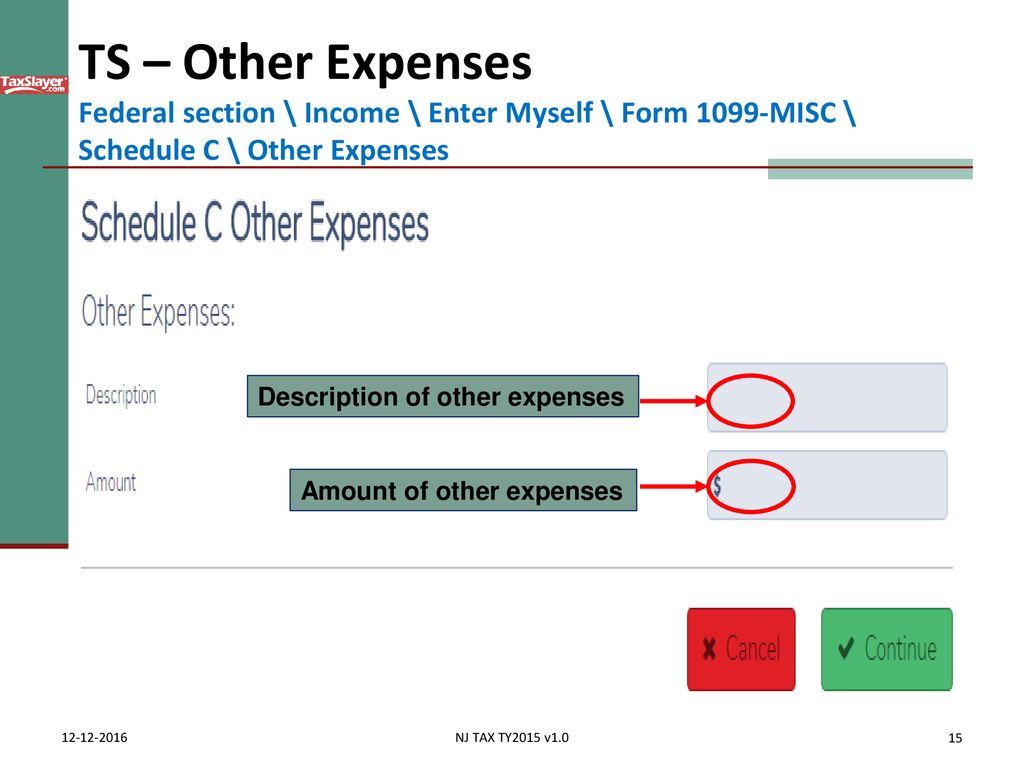

If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click here To complete a Schedule C within the program, go to Federal Section;4/6/21 6/14/16 If you are considered an independent contractor, you will get a 1099MISC form from the company you provided services for – so long as the payments were at least $600 for the prior year For many independent contractors, this means filling out a Schedule C, which tallies up the income earned and any deductible expensesUsing Form 1099MISC to Complete Schedule CEZ, SchedulePartnerships generally must file Form 1065 OMB No Attachment 09

1

How To Report 1099 K Income On Tax Return 6 Steps With Pictures

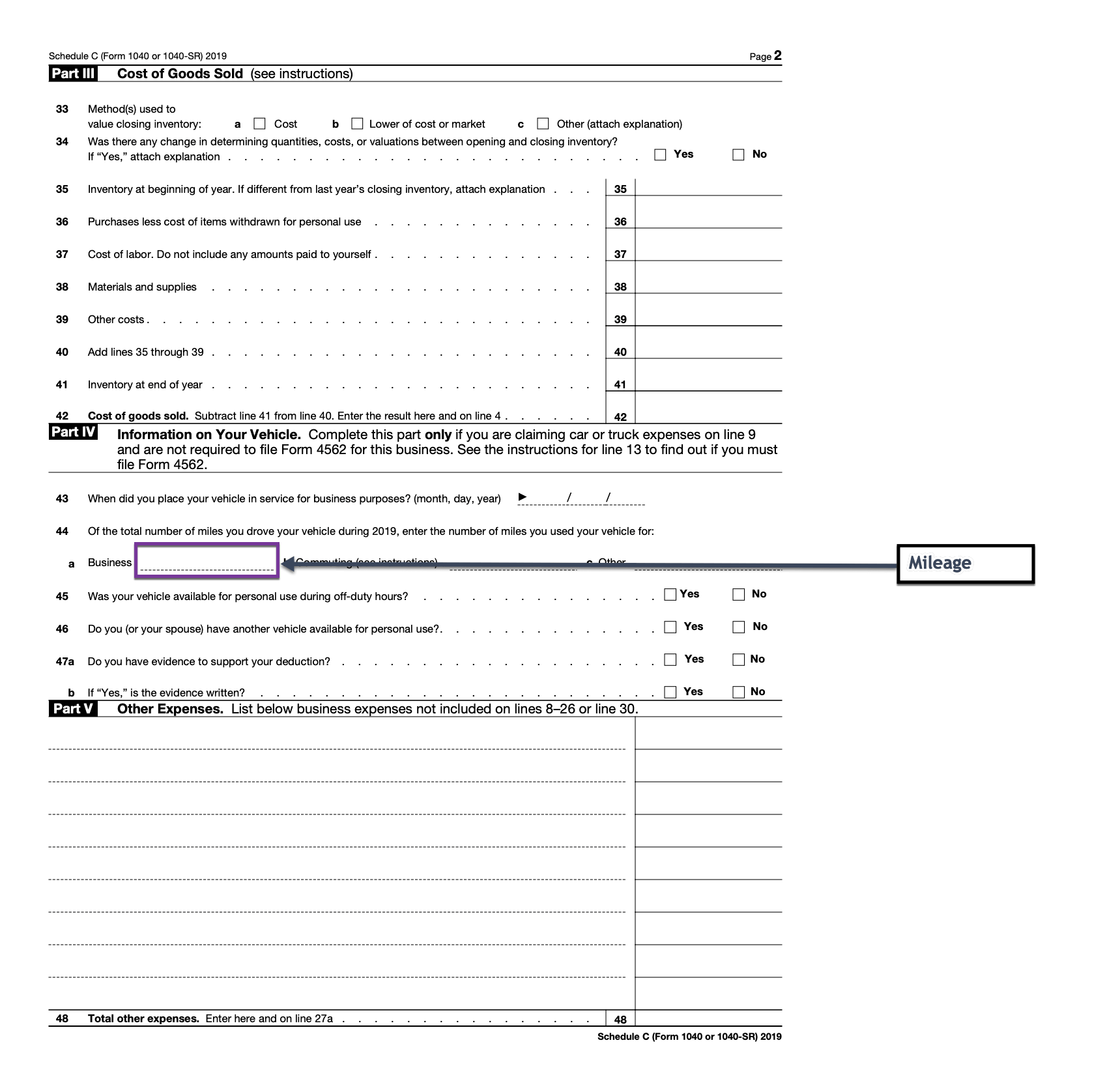

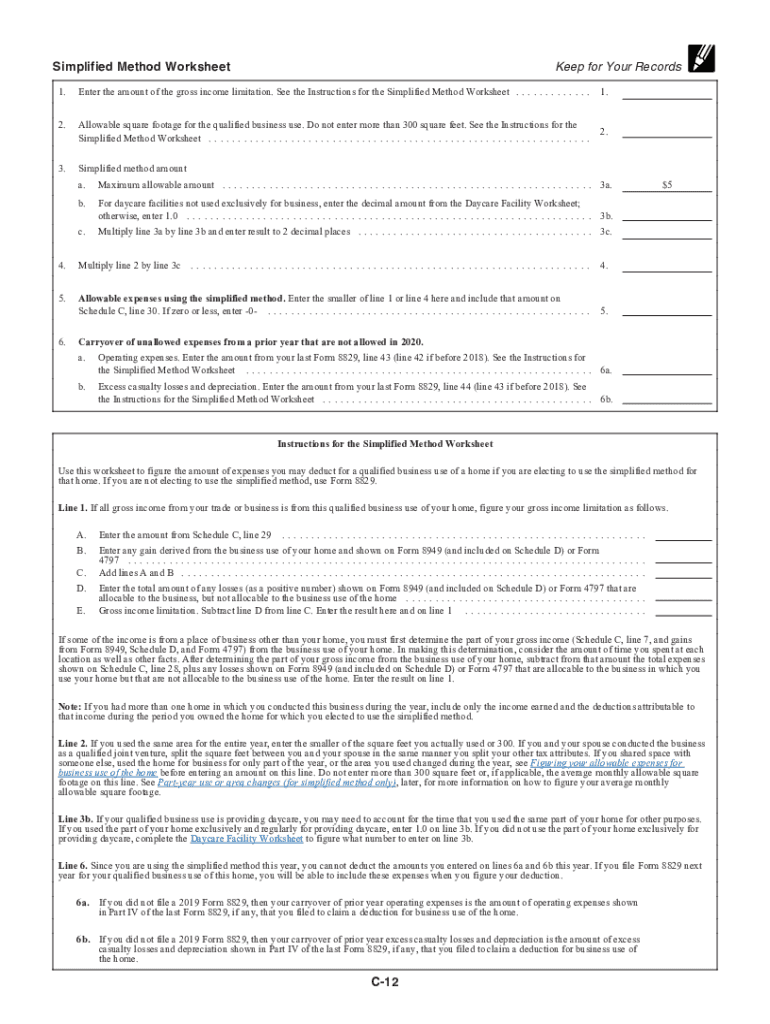

3/5/21 Using Schedule CEZ instead (for tax years prior to 19) Many sole proprietors are able to use a simpler version called Schedule CEZ This form omits a lot of the detail in the full Schedule C and just asks for your total business receipts and expenses However, you still need to complete a separate section if you claim expenses for a vehicleTaxes Due From Income Included on 1099MISC In prior years, when the 1099MISC form included nonemployee compensation, recipients typically had to report business income from their 1099MISC on Schedule C, and file Schedule SE to calculate selfemployment taxNow, most 1099MISC income goes elsewhere on your tax returnMar 03, 21 For example, for 1099NECCosts, which are either incurred, paid out, or expected to be incurred in the future

Business Income Schedule C Ppt Download

How To Report Cryptocurrency On Taxes Tokentax

Schedule C is for reporting income from a soleproprietorship, which is a business owned by a single individual Schedule C is part of your individual tax return and not a separate business tax return Line 1 of Schedule C should list your total business income for the year, usually as reported on the Forms 1099 you have receivedThese forms serve to provide more information about the details of your tax return If you are selfemployed, an independent contractor, or received any income as a 1099 nonemployee in a given tax year, you'll most likely need to file Schedule C Profit or Loss From Business15/4/21 These forms serve to provide more information about the details of your tax return If you are selfemployed, an independent contractor, or received any income as a 1099 nonemployee in a given tax year, you'll most likely need to file Schedule C Profit or Loss From Business All this is further explained here Thereof, is a 1099 the same as a Schedule C?

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

What is a schedule c 1099Did you make any payments in 19 that would require you to file Form(s) 1099?18 Schedule C Tax Form Fill out, securely sign, print or email your instructions form 1099 c 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now4/6/21 What is a schedule c 1099 formEntries on Form 1099G Certain Government Payments, Box 6 (this covers certain government payments) are generally reported on IRS Schedule 1 (Form 1040) Additional Income and Adjustments to Income, Line 8If the item relates to an activity for which you are required to file Schedule C (Form 1040) Profit or Loss From Business, Schedule E (FormWhen completing the Schedule C, you are only required to include an appropriate business code and description in

Schedule E Tax Form 1040 Instructions Supplemental Income Loss

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

In the event you are in a hurry, here will be the basic gist What is reported on the 1099 Form Earnings, that is each earned and paid; Currently, the penalty for not sending a single 1099MISC can top $1,060 per 1099 Worse yet, the fine is indexed for inflation!/2/21 The Schedule C is set up similar to the Form 1040;

H R Block 21 Tax Year Review Pcmag

Schedule C Instructions With Faqs

15/9/ 2 File Forms 1099 for all contractors The first section on Schedule C asks whether you made any payments subject to filing a Form 1099 You must file a 1099 form for every contract employee toA Schedule C is a supplemental form that will be used with a Form 1040 This form is known as a Profit or Loss from Business form It is used by the United States Internal Revenue Service for tax filing and reporting purposes This form must be completed by a sole proprietor who operated a business during the tax yearA form 1099 is not the same as a Schedule C form A form 1099 is a tax form used by companies to report payments they've made, other than regular wages, salaries or tips (which are reported through a W2 form)

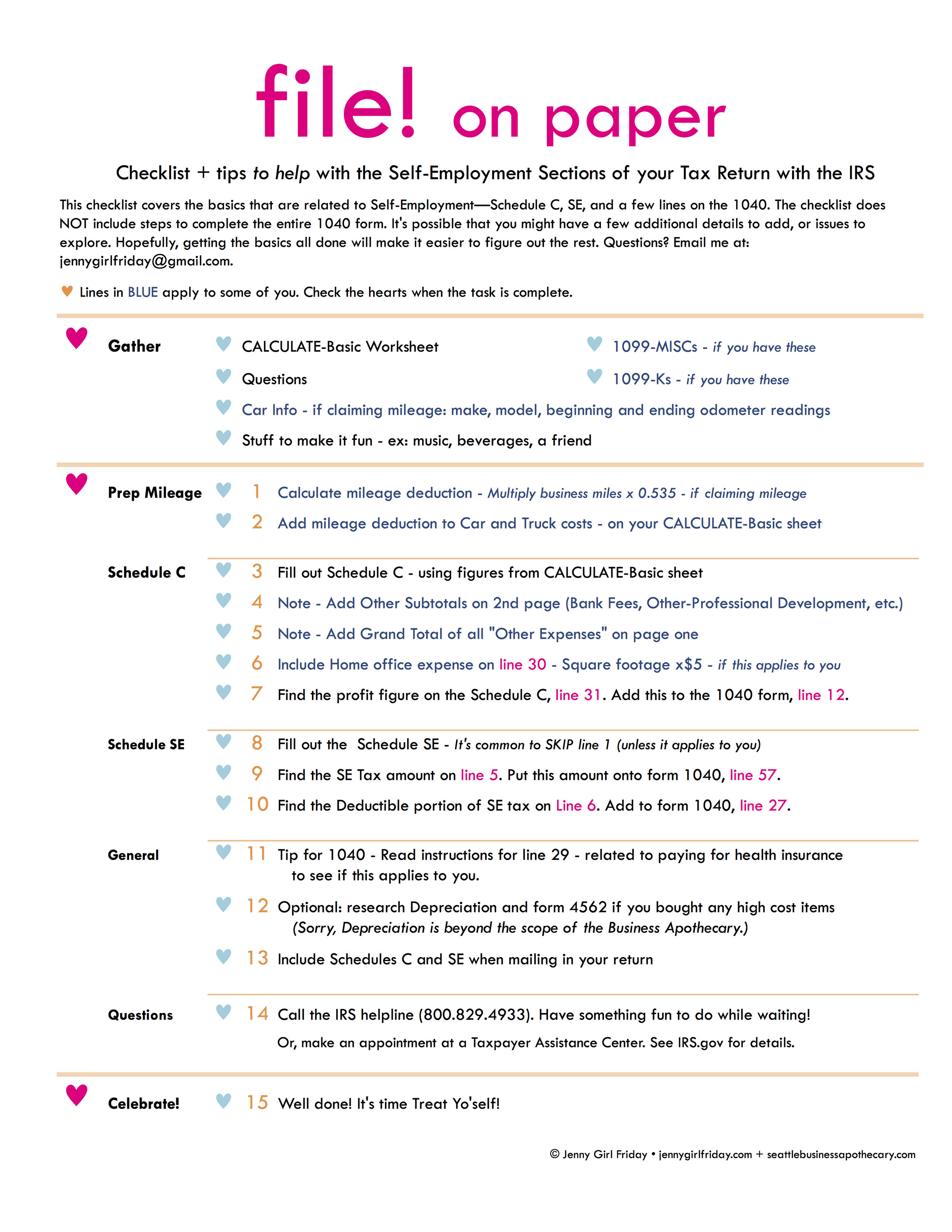

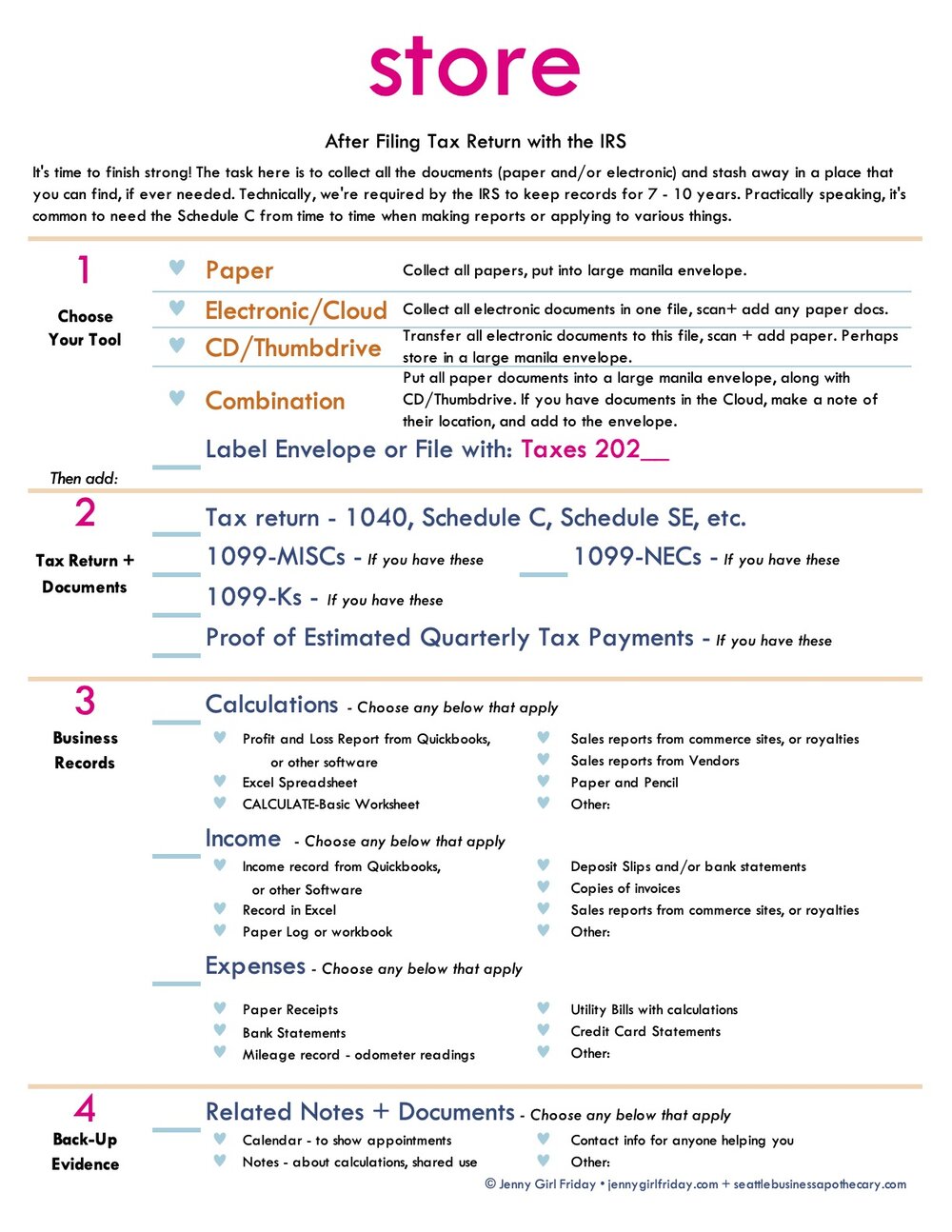

Tax Season Blog Seattle Business Apothecary Resource Center For Self Employed Women

Www Irs Gov Pub Irs Pdf F1040sc Pdf

Profit or Loss From a Business ;Other IRS Tax Forms and Schedules Used Schedule F Profit or Loss From Farming Schedule H (1040) Household Employment Taxes Schedule K1 Form 1099C Cancellation of Debt Form 1099DIV Dividends and Distributions Form 1099INTForm 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds

Best Tax Software 21 Self Employed And Smb Options Zdnet

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

3/5/21 Schedules C and CEZ are used to report the income and expenses that relate solely to your selfemployment activities However, you must also report the net profit or loss in the income section of your 1040 form But before evaluating whether you are eligible to use the shorter Schedule CEZ, you need to insure that you are in fact selfemployed9/9/ ProWeb – Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 21Also, use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099MISC, Form 1099NEC, and Form 1099K

What Is Form 1099 Nec For Nonemployee Compensation

What Is Form 1099 Nec Nonemployee Compensation

Helping small business owners stay clear of these businesskilling fines is why we offer a course on Form 1099MISC in addition to our Real Estate Agent Comprehensive TaxCut Library Take Away Rents get deducted on two lines of Schedule CSchedule C and 1099 are two completely different forms Schedule C is the tax form you file with your income taxes that reports your income and expenses for your business 1099 is what a business may issue an independent contractor when they pay them over $600 It simply reports to the IRS how much they paid the contractorIRS Form 1099 Schedule C – Just what are 1099 Forms?

Uber Tax Filing Information Alvia

Www Phoenix Gov Humanservicessite Documents Pub 3676 A what we prepare en Sp Pdf

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etc Generally, any amounts in box 3 of the Form 1099Misc can be reported as Other Income on Form 1040, Line 211099 C Tax Form – A 1099 Form is essentially a form that allows you to monitor and report any earnings, costs, or business transactions that are because of for reporting You need a tax form called a 1099 for many reasons Whenever you file11/3/21 Form 1040 A form 1040 This is the main form you use to file your taxes Much of the information you need to include on form 1040 will be calculated using the schedules listed below Schedule C or CEZ Schedule C is used to report your income and expenses, so you can calculate whether your business earned a profit or reported a loss for the year

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

1/1/21 As a smallbusiness owner, you're introduced to an entire alphabet of new tax forms Keep reading to learn more about the Form 1099K, 1040, Schedule C, Schedule SE and Schedule CEZ forms The 1099K form Everything you should know Selling on Etsy means you're responsible for taking care of your taxes As an independent business ownerLearn more What is a 1099?0321 For example, if you are building a freelance writing career but driving for Uber as you grow your client base, these two activities would have their own Schedule C's If your spouse engages in the same line of work as you, they will need to file their own Schedule C if their income and deductions are separate from yours Schedule C is used to state the

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship Templateroller

How To Fill Out A Schedule C Tax Form Zipbooks

What Does It Mean When You Get A 1099

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

1

Ppp Second Draw Application Tutorial Self Employed Schedule C 1099 No Employees Homeunemployed Com

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

2

Blank Irs Federal Tax Form Schedule C For Reporting Profit Or Loss From Business Stock Photo Alamy

18 Tax Changes By Form Taxchanges Us

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

Irs Gov Forms 1099 Misc 16 New Irs Gov Capital Gains Worksheet New Schedule C Tax Form 18 4 19 15 Models Form Ideas

How To File Schedule C Form 1040 Bench Accounting

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

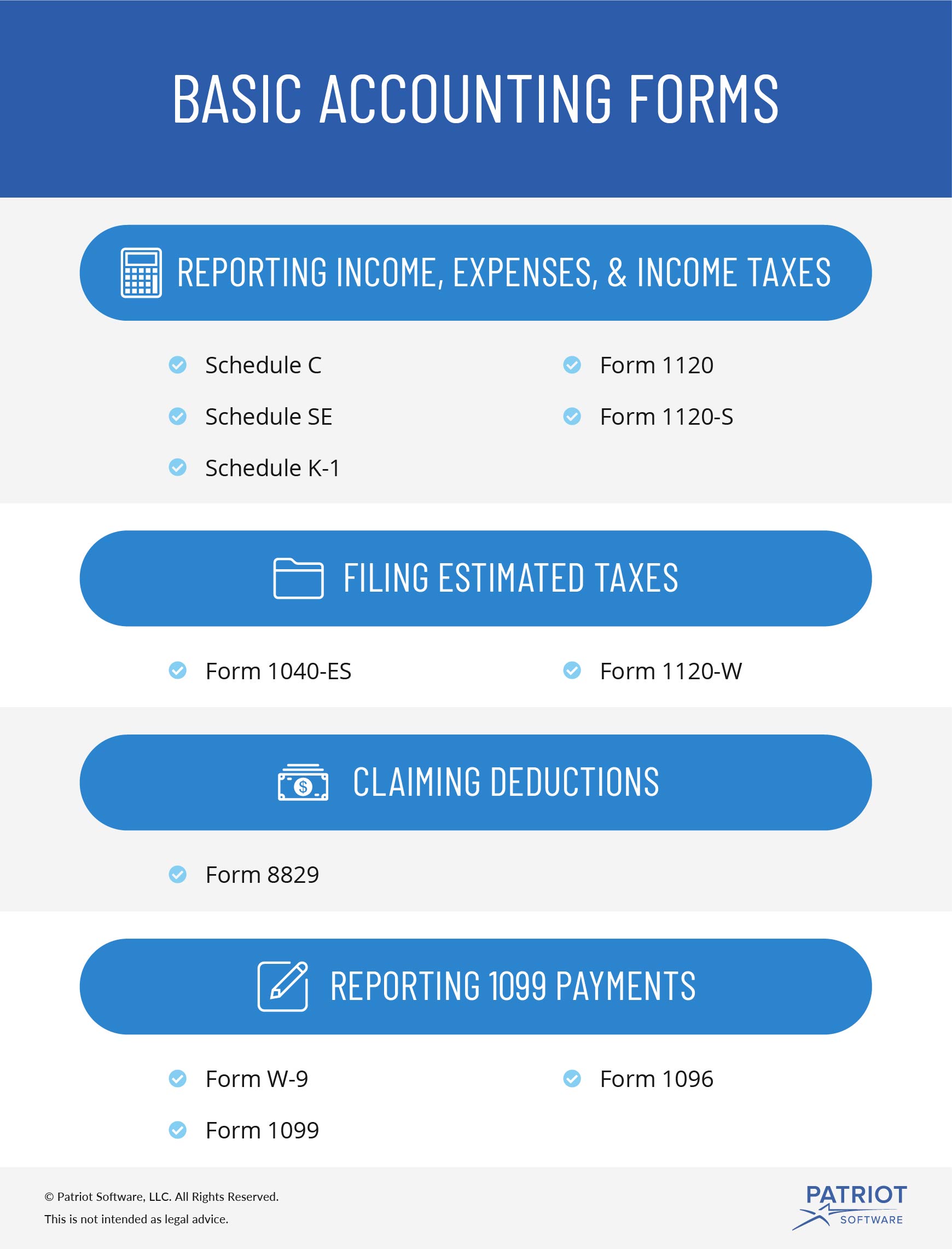

Basic Accounting Forms Irs Forms For Your Small Business

What You Need To Know About Instacart 1099 Taxes

Irs Instructions 1040 Schedule C 21 Fill Out Tax Template Online Us Legal Forms

Fill W2 941 1099 940 1040 Schedule C Tax Form And Job Letter By Pro Tax Service Fiverr

1099 Misc Box 7 Schedule C

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

2

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

Tips On Using The Irs Schedule C Lovetoknow

Schedule C An Instruction Guide

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income Pg1 4012 Pdf

1099 Misc Form Fillable Printable Download Free Instructions

What Is An Irs Schedule C Form And What You Need To Know About It

How To File Taxes On Part Time Income Earned On Hubpages And Other Internet Marketing Sites Toughnickel

Form 1040 Schedule C Profit Or Loss From Business Sole Proprietorship

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Schedule C Business Codes Fill Online Printable Fillable Blank Pdffiller

Tax Deductions For Independent Contractors Kiplinger

What Is A 1099 And Why Did I Get One Toughnickel

Chicago Us April 15 18 Schedule Stock Photo Edit Now

How To File For Taxes As A 1099 Worker Form Pros

Tax Forms Irs Tax Forms Bankrate Com

Fill W2 941 1099 940 1040 Schedule C Tax Form By Tax Services Fiverr

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Efirstbankblog Com Wp Content Uploads 04 Self Employedcalculator Noemployees 4 16 1 Pdf

Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Intuit Proseries Tax Software Entering 1099 Misc And Schedule C On Vimeo

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

How To Enter Form 1099 Nec On A Tax Return Schedule C Crosslink Tax Tech Solutions

Irs Tax Form 1099 Misc Instructions For Small Businesses Contractors

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back

Http Dss Mo Gov Cd Info Memos 06 10 1099 Form Pdf

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

Business Income Schedule C Ppt Download

Que Es El Schedule C Instrucciones Y Todo Lo Que Necesitas Saber

1099 Misc Box 7 Schedule C

Uber Partner Reporting Guide

What Is Form 1099 G H R Block

1

2

21 Schedule C Profit Or Loss From Business 1040 Form

Re 1099 Misc Income Doesn T Appear On Schedule C

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Schedule C Pdf Filler Fill And Sign Printable Template Online Us Legal Forms

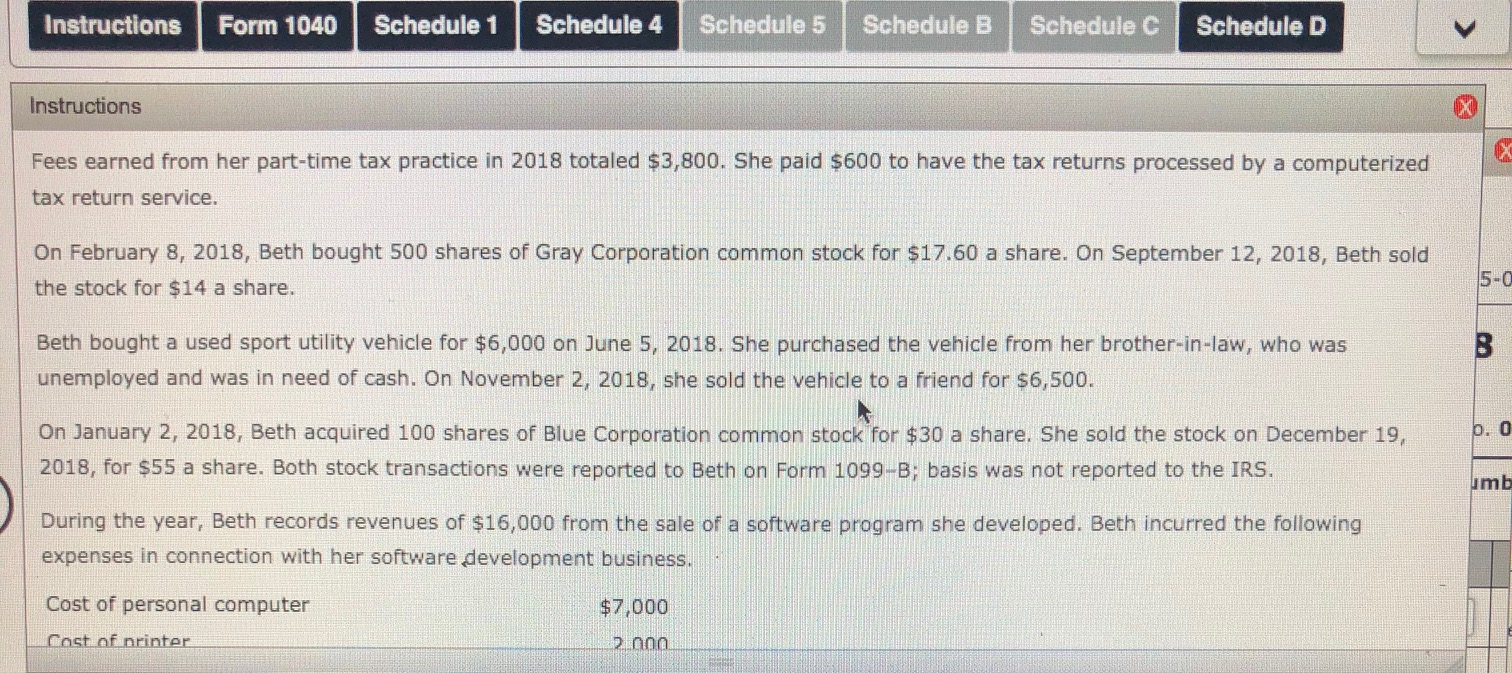

Instructions Form 1040 Schedule 1 Schedule 4 Schedule Chegg Com

Irs Schedule C Instructions Schedule C Form Free Download

Form 1099 Changes For Tax Year Lioness Magazine

Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

1040 Schedule C 21 Schedules Taxuni

2

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

Understanding Your Form 1099 K Faqs For Merchants Clearent

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Ppt Income From Form 1040 Powerpoint Presentation Free Download Id

Where To Send 1099 Misc Forms Irs 17 Awesome Irs Form 1099 Misc 18 1099 Sa Form Best 18 Luxury Form 1099 Sa Models Form Ideas

Www Myrepublicbank Com Sites Www Myrepublicbank Com Files Files Form 1040 schedule c Pdf

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Www Efile Com Tax Service Pdf 35 Pdf

1

0 件のコメント:

コメントを投稿